The U.S. Congress is advancing a sweeping tax reform bill known as the “One Big Beautiful Bill Act,” which proposes extensive tax cuts, spending adjustments, and new fiscal policies. This legislation aims to extend the 2017 Tax Cuts and Jobs Act (TCJA), introduce new tax credits, and implement significant changes to federal programs.

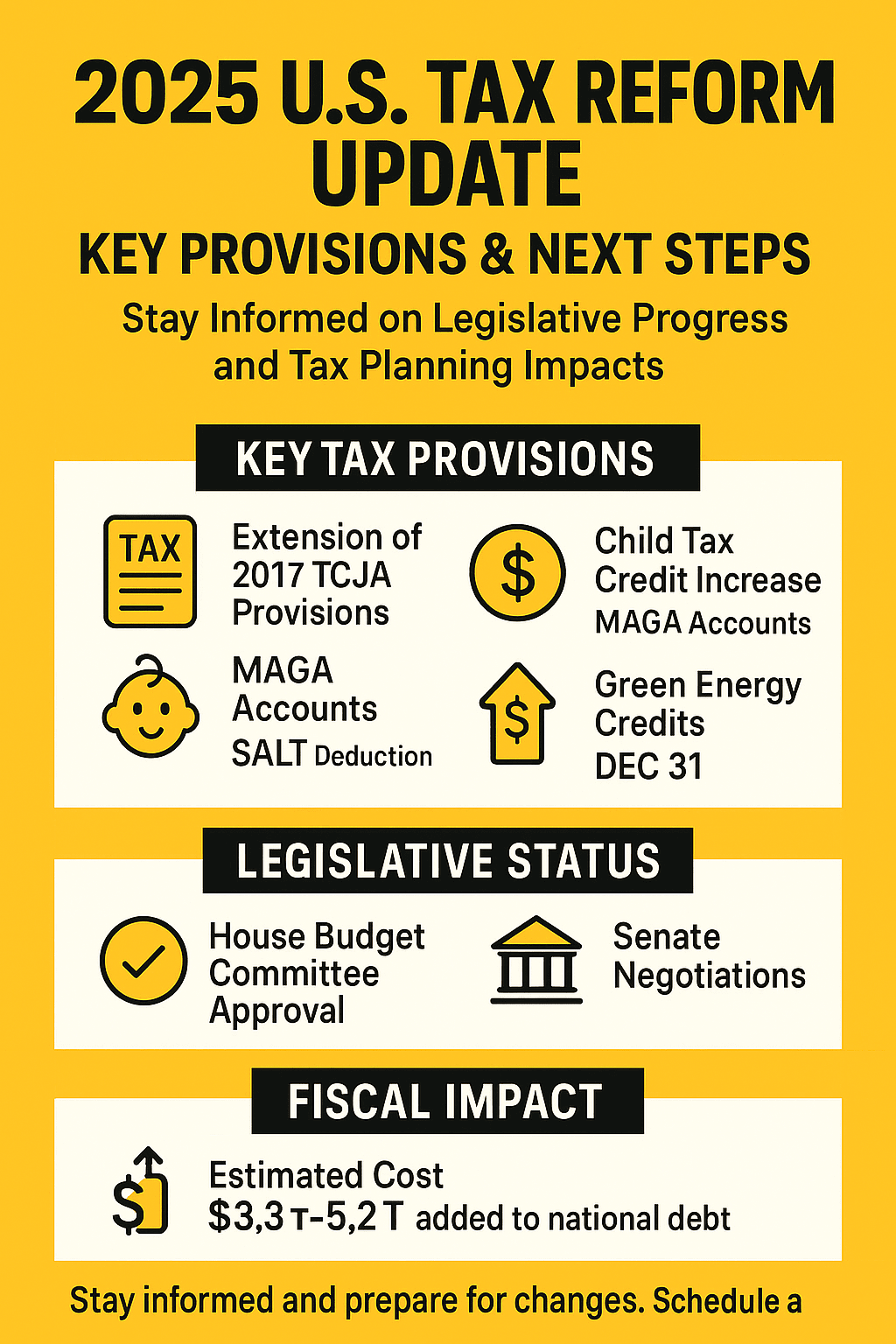

While the bill has passed the House Budget Committee, it faces further scrutiny and debate in Congress. Tax professionals and stakeholders should stay informed about these developments to anticipate potential impacts on tax planning and compliance.

Detailed Overview of Key Tax Provisions and Legislative Status

| Tax Provision | Description | Current Status | Next Steps |

| Extension of 2017 TCJA Provisions | Permanently extends individual tax cuts from the 2017 TCJA, including lower income tax rates and increased standard deductions. | Approved by House Budget Committee on May 18, 2025. | Awaiting full House vote; if passed, will proceed to the Senate. |

| Child Tax Credit (CTC) Increase | Increases the CTC from $2,000 to $2,500 for tax years 2025–2028; reverts to $2,000 thereafter. | Included in the House Ways and Means Committee proposal. | Subject to further debate; potential modifications in Senate. |

| Introduction of “MAGA” Accounts | Establishes $1,000 government-seeded savings accounts for children born between 2025 and 2028, with annual contribution limits. | Part of the proposed legislation; has bipartisan interest. | Legislative details to be finalized; monitoring for inclusion in final bill. |

| State and Local Tax (SALT) Deduction Cap Increase | Raises the SALT deduction cap from $10,000 to $30,000 for individuals earning up to $400,000. | Proposed in the House bill; facing criticism from lawmakers in high-tax states. | Potential revisions during House and Senate negotiations. |

| Medicaid and SNAP Reforms | Implements stricter work requirements and eligibility checks for Medicaid and SNAP beneficiaries. | Controversial provision; opposed by Democrats and some moderate Republicans. | Likely to be a focal point in upcoming legislative debates. |

| Elimination of Taxes on Tips and Overtime | Exempts tips and overtime pay from federal income taxation to benefit service industry workers. | Included in the House proposal; generally supported by Republicans. | Awaiting further legislative action; potential adjustments in Senate. |

| Termination of Green Energy Tax Credits | Ends tax credits for energy-efficient home improvements and residential clean energy after December 31, 2025. | Proposed in the bill; aligns with broader rollback of green energy incentives. | Subject to negotiation; environmental groups and some lawmakers may push back. |

| Fiscal Impact | Estimated to add $3.3 trillion to $5.2 trillion to the national debt over the next decade, depending on economic growth and revenue projections. | Analysis by the Committee for a Responsible Federal Budget and other nonpartisan groups. | Fiscal implications to be a central issue in legislative discussions. |

Implications for Tax Professionals

The proposed tax reforms could significantly alter the tax landscape, affecting individual taxpayers, businesses, and federal programs. Key considerations include:

- Tax Planning Adjustments: Potential changes to deductions, credits, and tax rates may necessitate revisions to tax planning strategies for clients.

- Compliance Updates: New provisions, such as the introduction of “MAGA” accounts and changes to eligibility for tax credits, will require updates to compliance procedures and client advisories.

- Fiscal Policy Monitoring: Understanding the broader economic implications of the bill, including its impact on the national debt and federal program funding, is crucial for advising clients on long-term financial planning.

Stay Informed and Prepared

As the legislative process unfolds, staying informed about the status and details of the tax reform bill is essential. Tax professionals should monitor updates from authoritative sources and be prepared to adjust strategies in response to enacted changes.

Ready to transform your practice with agentic AI in tax? Schedule a demo today and experience firsthand how our cutting-edge AI tax tools can revolutionize your approach to tax research and planning.