The 2025 “One Big Beautiful Bill” (OBBB) is set to transform the U.S. tax landscape significantly. Featuring sweeping provisions on individual and corporate taxes, the bill promises both winners and losers. Is it pro-growth? Here’s a clear breakdown of the major tax changes, who stands to benefit, who might face drawbacks, and what crucial aspects may have been overlooked. Read on to see where you or your clients might fall—this insight could be vital for strategic tax planning.

What is the One Big Beautiful Bill Act?

The 2025 One Big Beautiful Bill Act (OBBB) is a comprehensive tax reform proposal intended to simplify, modernize, and enhance fairness in the tax system. While not yet enacted, its ambitious nature could profoundly reshape taxation in America.

Major Tax Provisions and Changes

Individual Taxpayers

- Simplified Income Tax Brackets: Reduces from seven to three brackets (10%, 20%, and 30%).

- Higher Standard Deduction: Nearly doubles the standard deduction, reducing tax complexity for most Americans.

- Expansion of Child Tax Credit: Significantly increases eligibility and benefits, providing direct financial relief to families.

- Limits on Itemized Deductions: Introduces caps on popular deductions like mortgage interest and state/local tax (SALT) deductions, particularly impacting high-tax states.

Business and Corporate Taxes

- Lower Corporate Rate: Reduces corporate tax from 21% to 17% to encourage investment.

- Immediate Expensing: Allows businesses full immediate deduction for new equipment, bolstering business investment.

- Global Minimum Tax: Implements a minimum 15% tax on multinational corporations’ global income to limit profit shifting.

Investment and Retirement

- Enhanced Roth IRA Incentives: Creates increased contribution limits and broader availability, encouraging retirement savings.

- Capital Gains Reform: Introduces a lower tax rate on long-term investments to encourage capital formation.

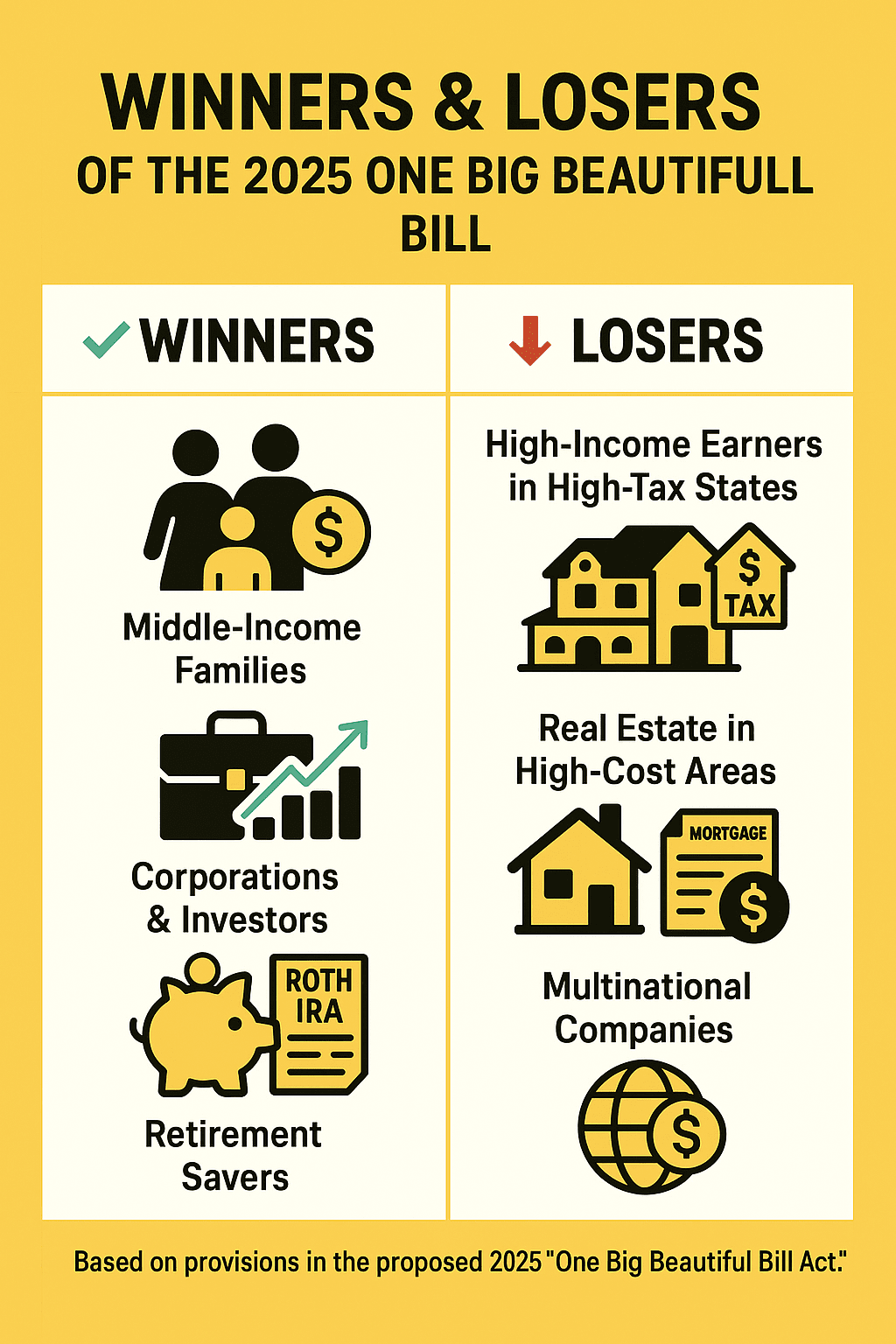

Winners: Who Benefits Most?

Middle-Income Families

Increased standard deductions, expanded child tax credits, and simplified brackets mean significant savings and ease for average-income earners.

Corporations and Investors

Reduced corporate taxes and incentives for immediate expensing position businesses for higher profitability and investment growth. Investors benefit from favorable capital gains tax treatment, enhancing portfolio returns.

Retirement Savers

Expanded Roth IRA opportunities and higher contribution limits facilitate robust retirement planning, providing long-term financial security.

Losers: Who Faces Setbacks?

High-Income Earners in High-Tax States

Limits on SALT deductions significantly raise effective taxes for affluent taxpayers in states like California and New York.

Real Estate Market in High-Cost Areas

Caps on mortgage interest deductions may dampen real estate prices, particularly in luxury markets.

Multinational Companies

A global minimum tax creates compliance burdens and reduces profitability from previously advantageous tax arrangements.

Is the OBBB Pro-Growth?

The OBBB Act generally leans pro-growth. Lower corporate rates and immediate expensing encourage investment, innovation, and job creation. Simplifying tax brackets and enhancing retirement savings incentives further stabilize economic growth through consumer confidence and financial planning certainty.

However, specific provisions—like limitations on SALT and mortgage deductions—may curtail economic activities in some affluent and highly taxed regions, counterbalancing some pro-growth elements.

What are the Misses?

- Minimal Addressing of Income Inequality: Despite simplifications and enhancements, OBBB lacks robust measures targeting wealth disparity, potentially widening existing socioeconomic gaps.

- Limited Support for Environmental Initiatives: Minimal incentives are offered for clean energy or sustainability, missing opportunities to align tax policy with climate goals.

- Complex Global Compliance Burdens: The introduction of a global minimum tax might prove administratively burdensome, reducing the competitive advantage of U.S.-based multinationals globally.

Conclusion and Next Steps

The 2025 One Big Beautiful Bill Act offers transformative changes promising relief for middle-class families and incentives for business growth. Yet, careful planning is necessary, especially for high earners in high-tax states and multinational businesses.

If you need clarity or strategic advice on how these proposed changes might impact your financial future, now’s the time to start planning. Contact us today for personalized, AI-driven tax planning tailored precisely to your needs.