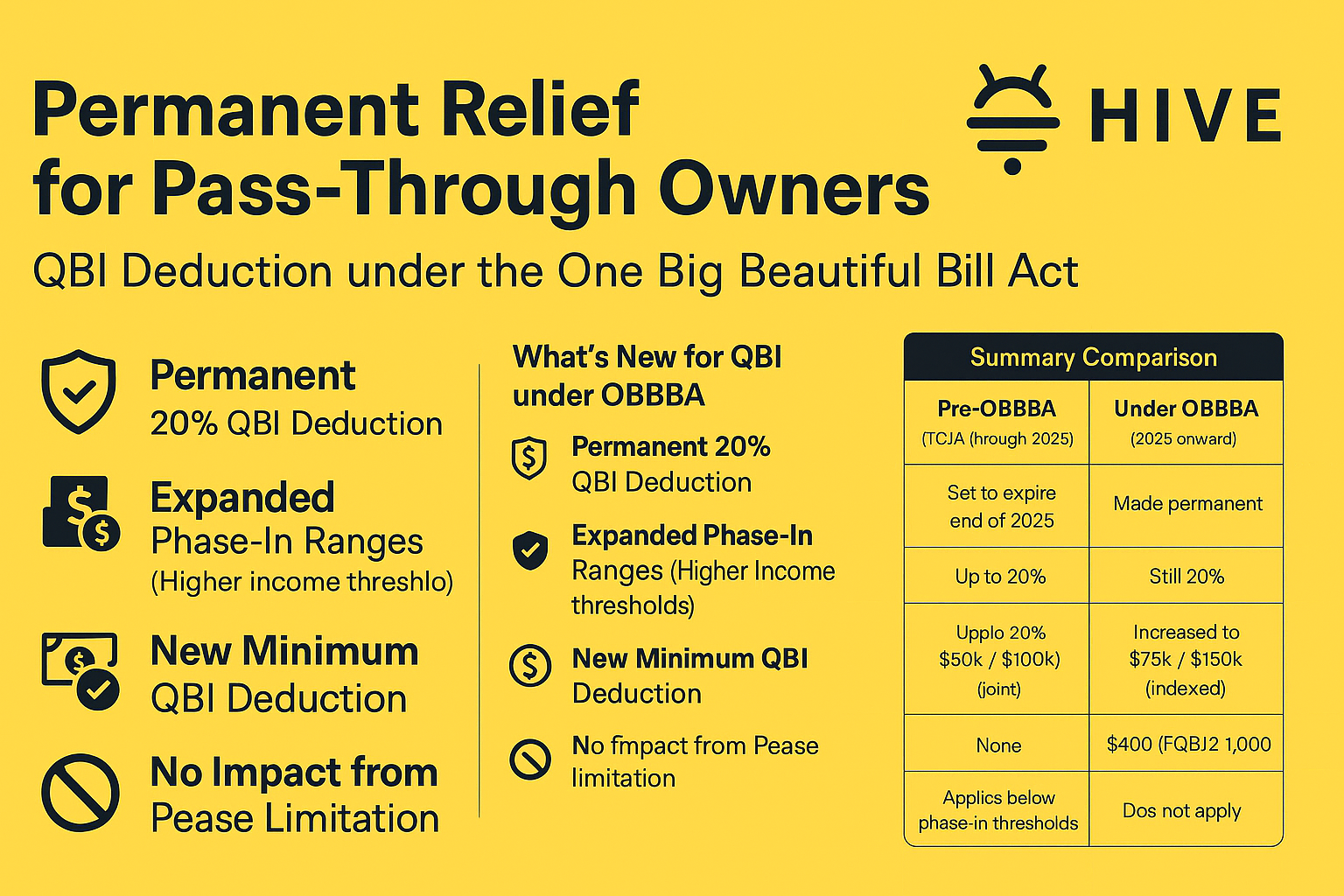

Under the new One Big Beautiful Bill Act (OBBBA), the Qualified Business Income (QBI) deduction is now permanent, more generous, and includes a minimum guaranteed deduction—good news for small business owners. Explore how AI tax research and AI tax tools can help you navigate these changes and optimize planning. Click to learn more about leveraging agentic AI in tax planning to maximize your benefits.

What’s New for QBI under OBBBA

1. Permanent 20% QBI Deduction

OBBBA makes permanent the 20% deduction for QBI under Section 199A, eliminating the previous sunset after 2025 .

2. Expanded Phase‑In Ranges (Higher Income Thresholds)

Income thresholds triggering wage/property limitations or SSTB exclusion have increased from $50,000 to $75,000 for single filers, and from $100,000 to $150,000 for joint filers. These thresholds will be indexed for inflation beginning in 2026 .

3. New Minimum QBI Deduction

For active business owners with at least $1,000 of QBI from material participation, a minimum deduction of $400 (inflation‑adjusted after 2026) is available—even if other tests might reduce the deduction .

4. No Impact from Pease Limitation

The revamped Pease limitation on itemized deductions for high‑income taxpayers—returning in 2026—does not limit the QBI deduction.

Summary Comparison

| Feature | Pre‑OBBBA (TCJA through 2025) | Under OBBBA (2025 onward) |

| Deduction Permanency | Set to expire end of 2025 | Made permanent |

| Deduction Rate | Up to 20% of QBI | Still 20% |

| Phase‑In Range | $50k / $100k (joint) | Increased to $75k / $150k (indexed) |

| Minimum Deduction | None | $400 if QBI ≥ $1,000 |

| SSTB Exclusion | Applies below phase‑in thresholds | Same thresholds (higher amounts) |

| Pease Limitation | Not specified | Does not apply |

How AI Tax Tools Can Help You Plan Strategically

With these new permanent rules in place, it’s essential to plan ahead—and that’s where AI tax research and AI tax planning tools become invaluable:

- Carry out scenario analyses: Use an AI tax planning tool to model income changes, property investments, and wage allocations, predicting the QBI deduction under various strategies.

- Monitor phase‑in thresholds: As OBBBA indexes thresholds after 2026, AI tax research platforms can stay updated on inflation adjustments, guiding proactive adjustments in your business structure.

- Claim the new minimum deduction: An agentic AI in tax workflow can screen all active business owners across clients, flag those with QBI between $1,000–$5,000, and ensure the correct minimum deduction is claimed.

Recommended Tools & Resources

- IRS.gov – Section 199A guidance and QBI withholding rules (for formal definitions, material participation rules, wage/property limits).

- Tax Foundation – Analysis of OBBBA’s tax provision changes including revenue impacts and extenders.

- Barnes Dennig and H&R Block blogs – Practical breakdowns and planning insights about the expanded QBI provisions.

- Agentic AI tax platforms like TaxAI Pro, QBITool (hypothetical names)—they support automatic QBI deduction modeling, client-specific projections, and real‑time updates as thresholds change.

Bottom Line

The One Big Beautiful Bill Act locks in vital tax benefits for pass‑through business owners:

- QBI deduction is now permanent

- Limits are more inclusive

- A minimum deduction helps small active owners

You can’t implement these changes alone. Leveraging AI tax research, powerful AI tax tools, and agentic AI in tax planning systems will help ensure you maximize your deductions—accurately and efficiently.

Ready to level up your planning?

Discover how our AI tax planning tool can automate these calculations, future‑proof your QBI strategies, and keep you compliant with threshold indexing. Reach out to us for a product demo today.

Try our AI tax tool today or book a free demo and see how you can serve your clients with confidence, accuracy, and speed.