HIVE TAX AI

Lotus Li

Lotus Li is a CPA who has transformed 20 years of professional experience into building products with a mission to simplifying everyone’s tax journey. She is passionate about bringing cutting-edge AI into the world of tax and finance and is deeply immersed in designing, building, and launching innovative AI-powered tax solutions.

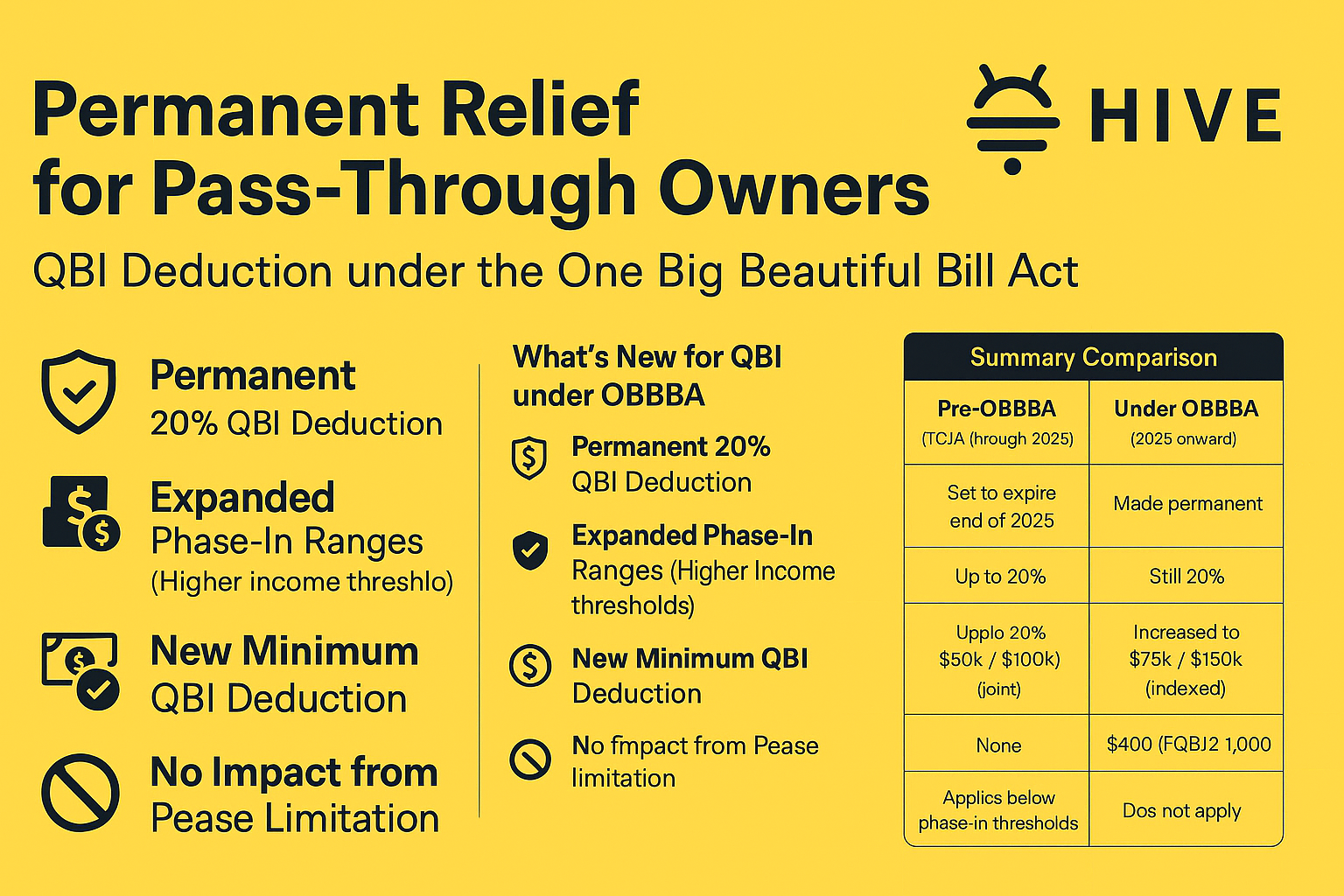

Permanent Relief for Pass‑Through Owners: QBI Deduction under the One Big Beautiful Bill Act (OBBBA)

Under the new One Big Beautiful Bill Act (OBBBA), the Qualified Business Income (QBI) deduction is now permanent, more generous, and includes a minimum guaranteed deduction—good news for small business owners.

Feature Release: Secure File Upload is Here!

We’re thrilled to announce a major upgrade to Hive Tax AI: Secure File Upload is now live on our AI tax research platform!

You can now upload tax returns, IRS notice letters, and other documents directly into our AI assistant, enabling smarter, faster, and more accurate research—powered by your actual supporting documentation.

Maximizing §179 Expensing with OBBBA

Discover how the One Big Beautiful Bill Act (OBBBA) elevates Section 179 expensing limits—now $2.5 million with a $4 million phase‑out, indexed for inflation.

Section 179 in Action: Practical Examples of Small Business Expensing Under OBBBA

Section 179 expensing remains one of the most powerful immediate tax relief tools for small businesses—especially under the new One Big Beautiful Bill Act (OBBBA)

Unlocking 100% Bonus Depreciation Under OBBBA: A Game‑Changer for Capital Investment

Discover how the One Big Beautiful Bill Act (OBBBA) brings back 100% bonus depreciation and why it’s a golden opportunity for businesses. Learn exactly what qualifies,

The New 0.5% AGI Floor for Itemized Deductions Under OBBBA: What Tax Professionals Need to Know

The One Big Beautiful Bill Act (OBBBA) introduces a 0.5% AGI “floor” on itemized deductions—an important shift for taxpayers and advisors alike. This blog explores what this new threshold means, who it affects, and how tax professionals can leverage AI tax research...

New AGI Percentage Limits for Charitable Contributions Under the One Big Beautiful Bill Act (OBBBA): What Tax Pros Need to Know

The One Big Beautiful Bill Act (OBBBA) brings major changes to the AGI percentage limits for charitable contribution deductions. Key provisions introduce a 0.5% AGI “floor” for individual deductions and a 1% floor for corporations, impacting how much taxpayers can deduct for charitable gifts.

Empowering Non-Itemizers: The Above‑the‑Line Charitable Deduction in the One Big Beautiful Bill Act

A game‑changer for everyday donors: beginning in 2026, the One Big Beautiful Bill Act introduces an above‑the‑line charitable deduction—allowing non‑itemizers to deduct up to $1,000 (single) or $2,000 (joint) for cash contributions without itemizing.

How does the new law affect itemized deductions, especially for medical expenses and mortgage interest under the One Big Beautiful Bill?

The One Big Beautiful Bill introduces significant changes to the itemized deduction framework that will fundamentally alter how taxpayers calculate their tax liability.

What are the new rules for deducting auto loan interest, and who qualifies under the One Big Beautiful Bill?

The One Big Beautiful Bill introduces a significant new tax benefit that allows taxpayers to deduct interest paid on qualifying auto loans for personal use vehicles