HIVE TAX AI

Lotus Li

Lotus Li is a CPA who has transformed 20 years of professional experience into building products with a mission to simplifying everyone’s tax journey. She is passionate about bringing cutting-edge AI into the world of tax and finance and is deeply immersed in designing, building, and launching innovative AI-powered tax solutions.

How does the bill impact foreign investors and cross-border tax rules, including new penalty taxes under the One Big Beautiful Bill?

The One Big Beautiful Bill Act (OBBBA), signed into law on July 4, 2025, introduces significant changes to international tax policy that substantially affect foreign investors and cross-border tax rules.

Are there new reporting requirements or compliance deadlines for multinational businesses under the One Big Beautiful Bill?

The One Big Beautiful Bill Act (OBBBA) introduces several significant changes to reporting requirements and compliance deadlines that directly impact multinational businesses operating in the United States.

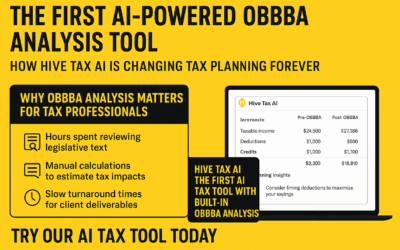

The First AI-Powered OBBBA Analysis Tool: How Hive Tax AI is Changing Tax Planning Forever

Hive Tax AI is the first and only platform to deliver a fully personalized OBBBA analysis using advanced AI. Our proprietary OBBBA Final Bill database and analysis engine are built directly into our AI tax research tool

How AI Tax Research Is Leveling the Playing Field for Small Accounting Firms

In the competitive world of accounting, smaller firms often feel they’re running at a disadvantage—especially when new tax laws arrive.

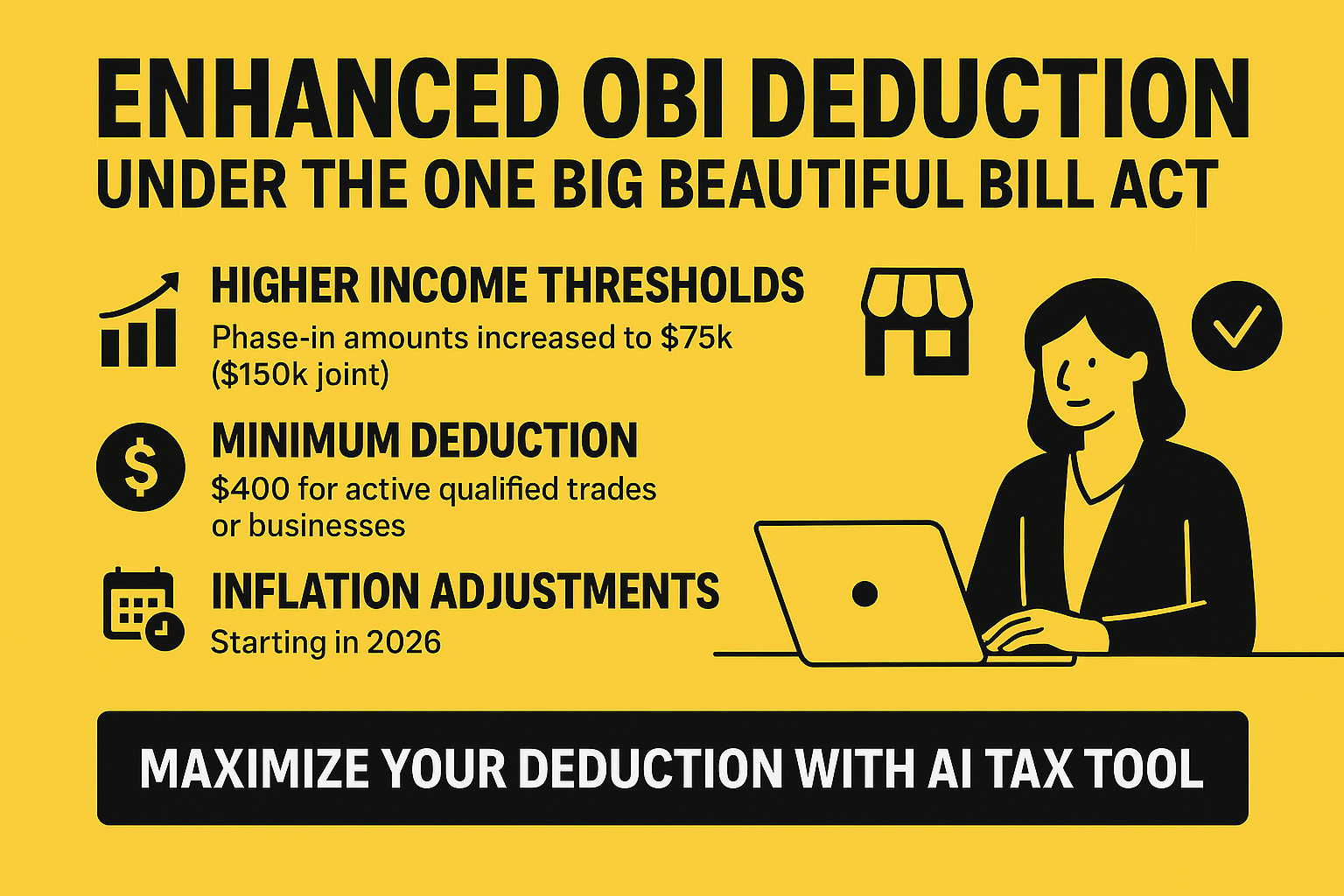

Enhanced Qualified Business Income (QBI) Deduction Under the One Big Beautiful Bill Act (OBBBA)

The One Big Beautiful Bill Act (OBBBA) introduces substantial enhancements to the Qualified Business Income (QBI) deduction, benefiting many business owners.

How to Choose the Right AI Tax Research Tool for the 2026 Tax Season

The 2026 tax season is right around the corner, and one thing is clear: AI-native tax research tools are no longer a novelty—they’re the future. With rapid innovation and increasing adoption by firms of all sizes, the landscape of tax research is evolving faster than...

Understanding Trump Accounts Under OBBBA: What Tax Professionals Should Know

Explore how the One Big Beautiful Bill Act (OBBBA) introduces Trump Accounts, its tax‑advantaged structure, contribution limits, and interplay with OBBBA’s individual tax rate changes.

How are pass-through entity (PTE) deductions and limitations affected, especially for specified service trades or businesses (SSTBs) under the One Big Beautiful Bill?

The One Big Beautiful Bill Act (OBBBA) introduces significant modifications to pass-through entity deductions and limitations, particularly affecting specified service trades or businesses (SSTBs).

What are the new rules for Qualified Small Business Stock (QSBS) gain exclusion under the One Big Beautiful Bill?

The One Big Beautiful Bill Act (OBBBA) introduces transformative changes to the Qualified Small Business Stock (QSBS) gain exclusion under Section 1202, representing one of the most significant enhancements to this provision since its original enactment.

Are there changes to the Excess Business Loss limitation for non-corporate taxpayers under the One Big Beautiful Bill?

The One Big Beautiful Bill Act (OBBBA) introduces significant modifications to the excess business loss limitation rules under Section 461(l), fundamentally altering the landscape for non-corporate taxpayers who experience business losses.