Stay ahead with the latest crypto tax updates! Significant new regulations start January 2025, including mandatory Form 1099-DA reporting, wallet-by-wallet cost basis accounting, and increased IRS scrutiny. Act now to ensure compliance and avoid costly mistakes. Read on to learn essential details and how to prepare effectively.

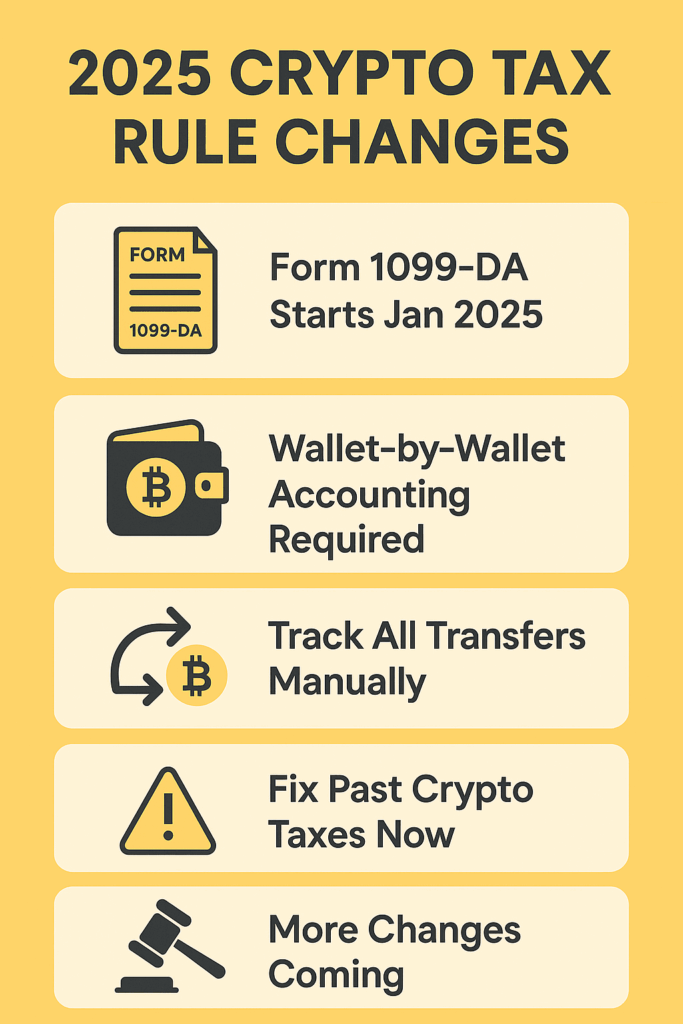

New Crypto Tax Form: Form 1099-DA

Beginning January 1, 2025, all U.S. cryptocurrency exchanges are required to track and report transactions using a new tax form—Form 1099-DA. Specifically designed for digital assets, Form 1099-DA provides the IRS with detailed information on your cryptocurrency transactions, increasing transparency and regulatory oversight.

Key takeaway: Ensure your transactions are accurately recorded by exchanges and verify the details provided on Form 1099-DA.

Wallet-by-Wallet Accounting Method

Previously, crypto investors could utilize a universal accounting method to calculate their cost basis across all crypto holdings collectively. However, effective January 1, 2025, this approach is no longer permitted. Instead, investors must use the wallet-by-wallet method, which calculates cost basis separately for each crypto wallet.

This method will require meticulous record-keeping, as investors need to maintain clear and separate records for every wallet they own.

Key takeaway: Start organizing your crypto holdings by wallet immediately to streamline compliance with the new regulations.

Transfers of Cryptocurrency Assets

The cryptocurrency space aims to adopt procedures similar to stock transfers between brokers, where cost basis and holding periods are communicated seamlessly between platforms. Although a comprehensive system for crypto isn’t yet in place, this development promises easier future compliance.

For now, crypto investors must continue to carefully track their own crypto transfers across wallets and platforms to accurately establish their cost basis.

Key takeaway: Maintain precise records of all crypto transfers between your wallets and exchanges to avoid inaccuracies.

Time to Address Prior-Year Crypto Taxes

With heightened IRS scrutiny coming in 2025, it’s critical to get your crypto tax affairs in order now. The complexity of filing accurately under the new rules makes catching up on any overdue tax reporting essential. The IRS has indicated a firm stance on compliance, making now the perfect moment to ensure all prior-year taxes are correctly filed.

Key takeaway: Don’t delay addressing past crypto tax obligations—taking action now could prevent substantial penalties and IRS scrutiny.

Expect Continued Regulatory Changes

Given the current regulatory climate under a relatively crypto-friendly Trump administration, investors should anticipate ongoing changes. Staying informed about regulatory developments and regularly consulting tax professionals will be critical to navigating this evolving landscape effectively.

Additionally, don’t overlook practical tools and resources that can assist you in complying with these new rules:

- IRS Guidance on Cryptocurrency

- Crypto Tax Software Solutions

- Professional Tax Advisory Services

Conclusion

With significant changes set to take effect in 2025, now is the time to ensure your crypto tax records are accurate and compliant. Staying proactive can help you avoid IRS penalties and simplify your future tax filings.

Ready to stay ahead of crypto tax regulations? Leverage professional advice and powerful AI tax tools designed specifically for crypto investors—contact us today to learn how our advanced AI tax research and tax planning tools can streamline your tax compliance.