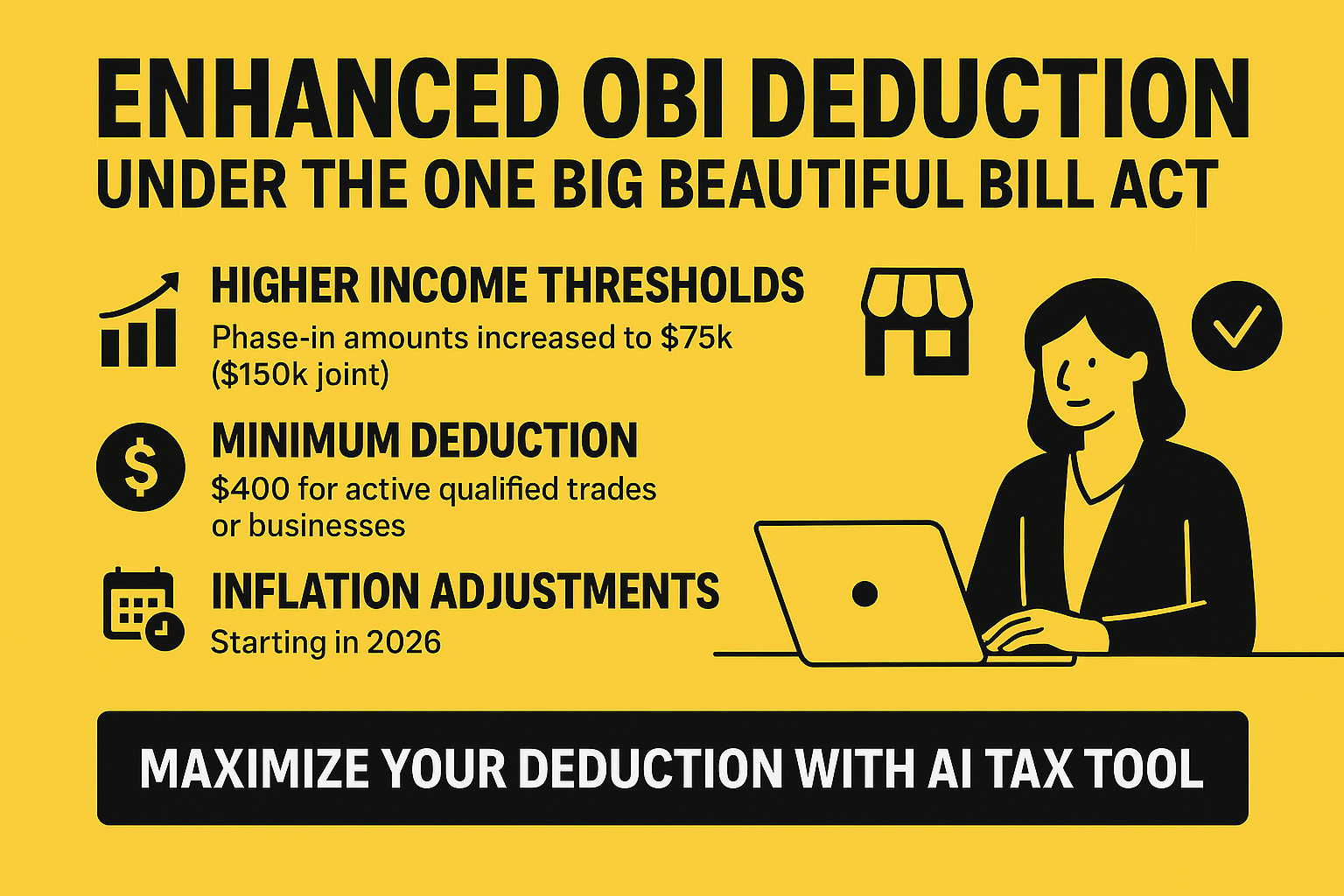

The One Big Beautiful Bill Act (OBBBA) introduces substantial enhancements to the Qualified Business Income (QBI) deduction, benefiting many business owners. Notably, OBBBA increases taxable income thresholds and establishes a minimum deduction, boosting deductions for taxpayers materially participating in their businesses. Learn how these updates impact your tax planning strategy and how AI tax research tools can simplify compliance.

Key QBI Deduction Changes under OBBBA:

- Increased Taxable Income Phase-in Amounts: Previously, the QBI deduction phased out at taxable incomes over $50,000 ($100,000 for joint filers). Under OBBBA, this threshold rises significantly to $75,000 ($150,000 for joint filers), allowing more business owners to benefit from the deduction.

- New Minimum Deduction: OBBBA introduces a minimum deduction of $400 for “applicable taxpayers”—those whose aggregate qualified business income from active trades or businesses is at least $1,000 annually. This ensures that even small-scale business operations can leverage some QBI deduction advantage.

- Inflation Adjustments: Beginning in 2026, the $400 minimum deduction and $1,000 qualifying threshold will be adjusted annually for inflation. This ensures that these benefits retain their value over time.

What Constitutes an “Active Qualified Trade or Business”?

Under OBBBA, an active qualified trade or business refers to any business in which the taxpayer materially participates, adhering to the guidelines established in IRS Section 469(h). This typically means the taxpayer regularly, continuously, and substantially engages in business operations.

Leveraging AI Tax Tools for Compliance and Optimization:

Implementing these new provisions requires precise planning. Utilizing cutting-edge AI tax research and planning tools can significantly streamline compliance and maximize your QBI deduction under OBBBA. AI tax planning tools can quickly analyze your tax scenario, help determine eligibility, and calculate optimal deductions, freeing you to focus on growing your business.

Conclusion:

The enhancements to the QBI deduction under OBBBA offer substantial opportunities for tax savings for many business owners. Staying informed and utilizing AI-driven tax planning tools can ensure you’re maximizing your deduction while remaining compliant.

Ready to Maximize Your QBI Deduction? Try our AI tax tool today or book a free demo and see how AI can revolutionize your workflow.