Contents

The Tax Planning Tool is an intuitive solution designed to help users optimize their tax situation by providing personalized strategies. By inputting key financial information, users can receive tailored tax planning advice that aligns with their specific goals and concerns. The tool incorporates our 2024 tax planning strategies and provisions from the Tax Cuts and Jobs Act (TCJA) to deliver the most relevant and effective tax-saving tactics.

Key Steps for Building a Tax Planning Strategy #

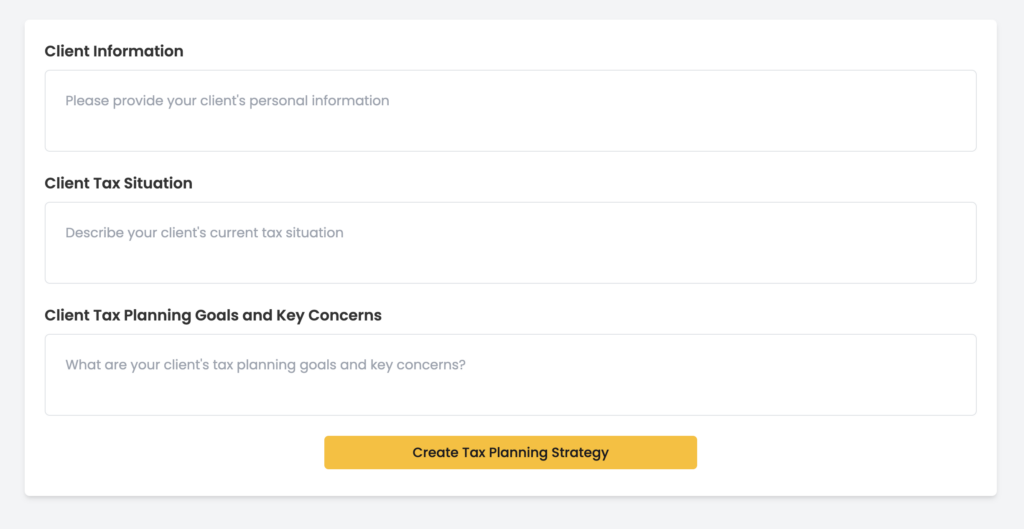

1. Client Information Input #

- Personal Information: Start by entering essential information, such as their income, filing status, and any other relevant financial details (e.g., dependents, homeownership, investments).

- Tax Situation: Based on the input, the tool analyzes the client’s current tax liabilities, deductions, credits, and filing history to form a baseline understanding of their situation.

- Tax Planning Goals: Specify your client’s primary tax objectives, such as minimizing taxes, maximizing deductions, planning for retirement, or optimizing estate taxes.

- Key Concerns: Highlight specific concerns, such as ensuring compliance with tax laws, preparing for future tax law changes, or understanding how recent life events (e.g., starting a business or purchasing property) impact their taxes.

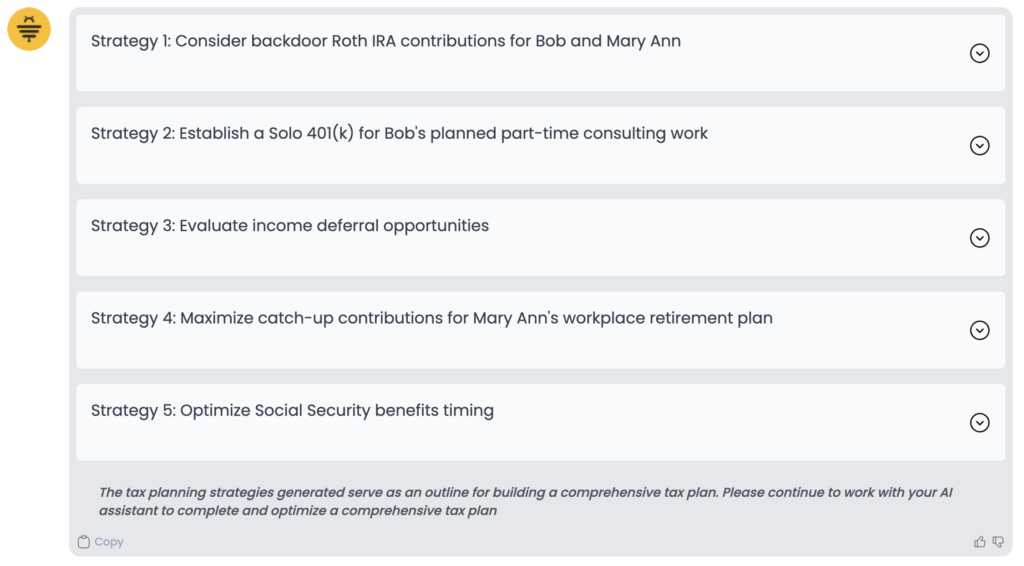

2. Tailored Tax Strategies #

Once the tool has compiled and completed gathering strategies pertinent to your client, you will be provided you with a list of strategies. You will be able to browse and decide which strategies work best for your client.

- 2024 Tax Planning Strategies: The tool integrates up-to-date tax strategies for 2024, including new deductions, credits, and regulations that apply to individuals and businesses.

- TCJA Strategies: It leverages provisions from the Tax Cuts and Jobs Act (TCJA), focusing on:

- Maximizing personal and business deductions

- Utilizing new tax brackets and rates

- Claiming child tax credits and family-related deductions

- Exploring Qualified Business Income (QBI) deductions for business owners

- General Strategy Guidance: Users can receive strategic advice on follow-up questions like, “How can I lower my taxable income?” or “What deductions apply to my small business?”

3. General Strategy Questions #

- Users can ask broad questions related to tax strategies and receive targeted responses. For example:

- “What are the best ways to maximize my deductions?”

- “How can I minimize capital gains tax on my investments?”

- “What tax advantages can I gain by contributing to an IRA or 401(k)?”

Benefits of Using the Tax Planning Tool #

- Personalized Advice: The tool generates tax strategies specific to the client’s unique tax situation, goals, and concerns.

- Up-to-Date Tax Planning: With 2024 tax laws integrated, users get the most current and effective strategies available.

- Comprehensive Strategy Coverage: From TCJA tax benefits to the newest tax-saving opportunities in 2024, the tool offers a wide range of insights.

- Clarity on Complex Tax Issues: The tool simplifies complex tax strategies, helping users understand their options and make informed decisions.

Example Tax Planning Process #

- Input Information: Enter details such as income, filing status, and deductions.

- Define Goals: Set specific tax planning goals (e.g., saving for retirement, minimizing taxes).

- Analyze Situation: The tool reviews the user’s current tax situation and applies relevant 2024 and TCJA strategies.

- Receive Strategies: The tool provides personalized tax recommendations.

- Ask Questions: The user can ask follow-up tax strategy questions to refine their plan.