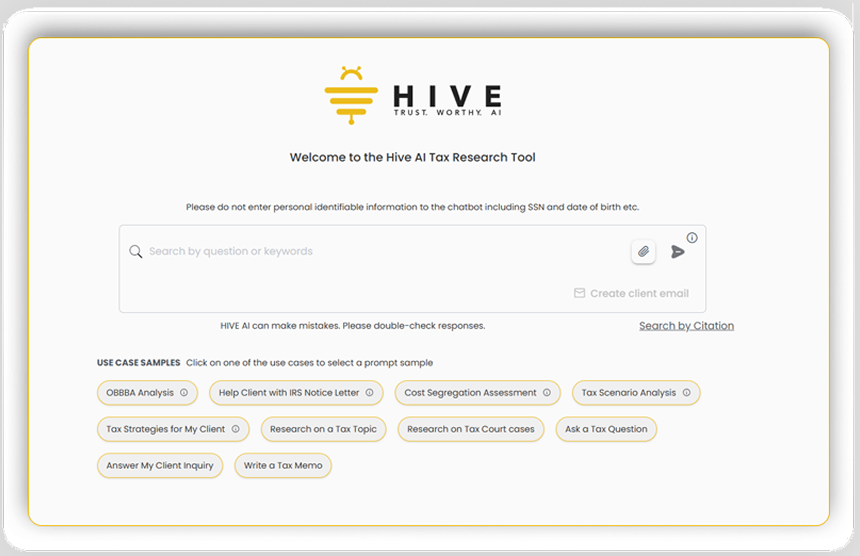

Best AI Tax Assistant Tool for CPAs

Work Smarter, Not Harder with Hive Tax AI

The 2026 tax season demands speed and accuracy. For CPA firms and accounting professionals, Hive Tax AI is the all-in-one tax research and planning assistant built to cut hours of manual work, reduce errors, and elevate your advisory capabilities. Hive Tax AI is designed specifically for tax professionals who need fast, authoritative answers and strategic insights all in one place.