Tax Planning Assistant

Upload. Analyze. Advise. All in Minutes

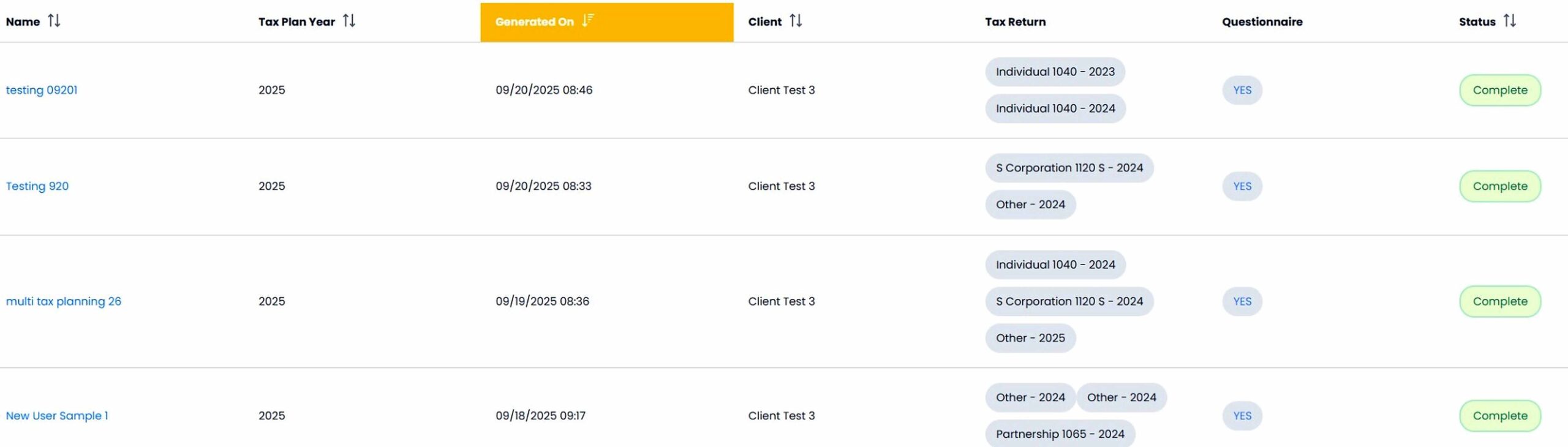

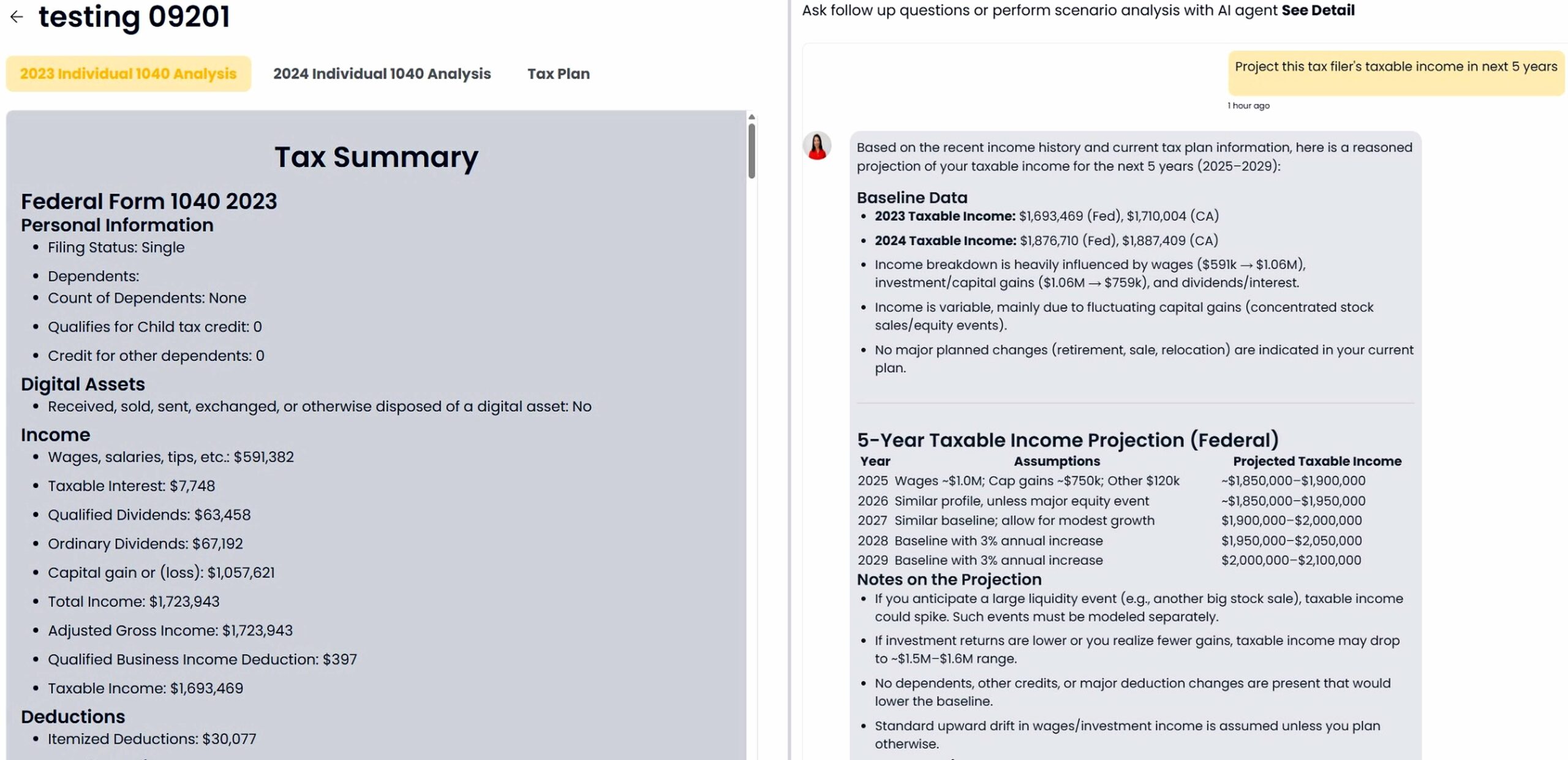

Securely upload personal or business tax returns and supporting documents, or complete a free-form questionnaire—your AI Tax Planning Assistant will then generate a personalized, comprehensive, and holistic tax plan.

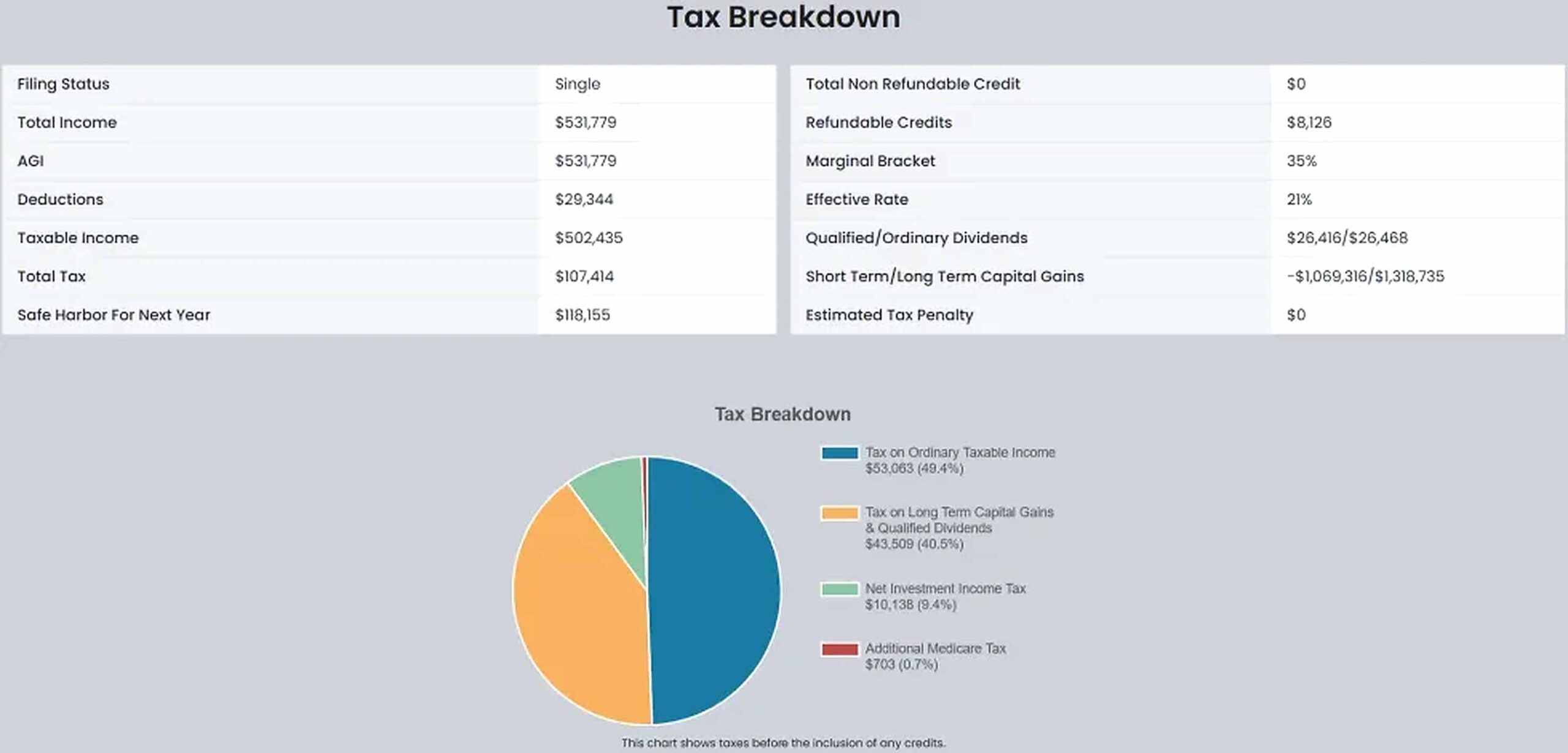

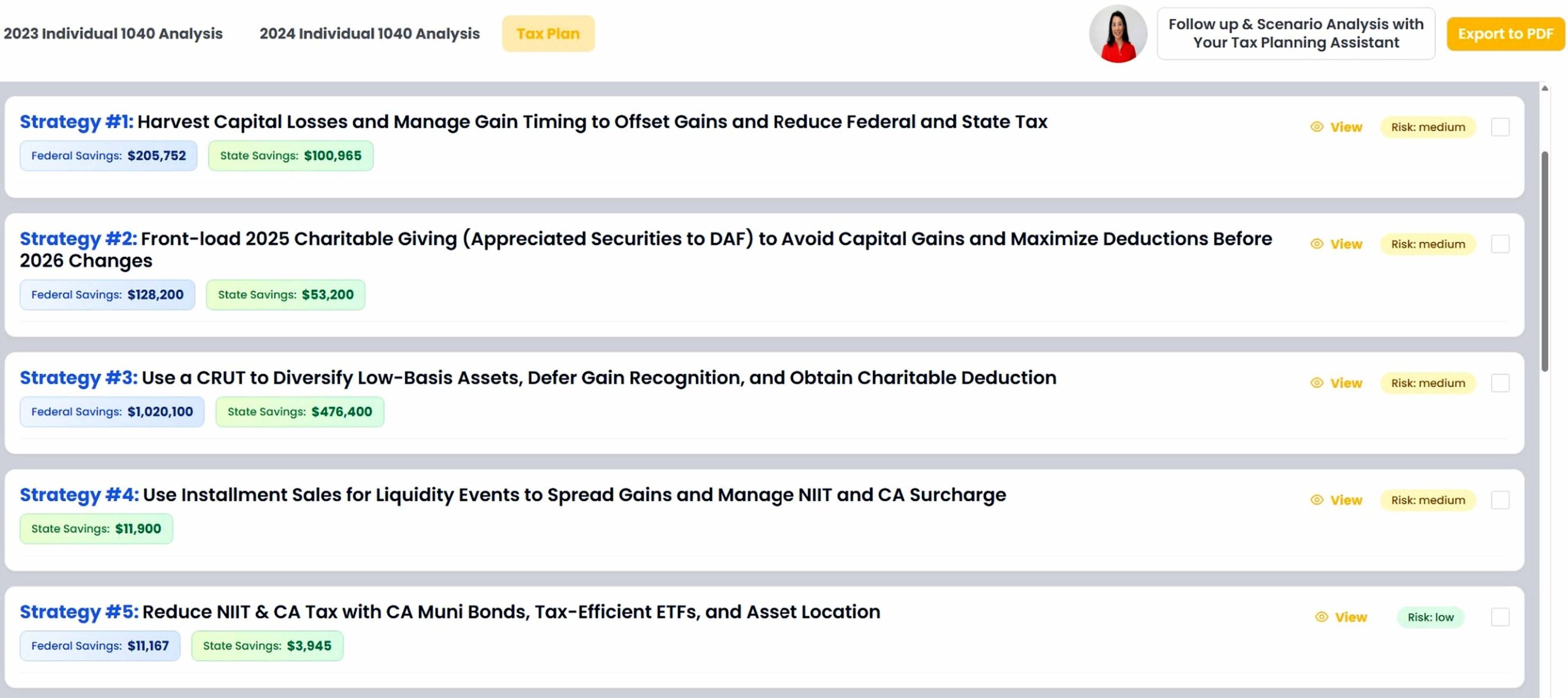

Specially trained in the latest tax planning strategies and updated quarterly, your AI Assistant doesn’t just identify hidden savings—it calculates them down to the dollar.

Deliver impressive, comprehensive reports on your branded letterhead. And it doesn’t stop there—tax advisory is a year-round service. Continue engaging with your AI Assistant throughout the year to provide ongoing, proactive advice to your clients.