Hive Tax AI is the first and only platform to deliver a fully personalized OBBBA analysis using advanced AI. Our proprietary OBBBA Final Bill database and analysis engine are built directly into our AI tax research tool, enabling CPAs, EAs, and financial professionals to instantly understand the One Big Beautiful Bill Act’s impact on their clients. Discover how this innovation is transforming AI tax research and AI tax planning.

Why OBBBA Analysis Matters for Tax Professionals

The One Big Beautiful Bill Act (OBBBA) introduces sweeping changes to tax rates, deductions, credits, and planning strategies. For tax professionals, understanding these changes isn’t just about reading the bill—it’s about knowing exactly how they affect each individual client.

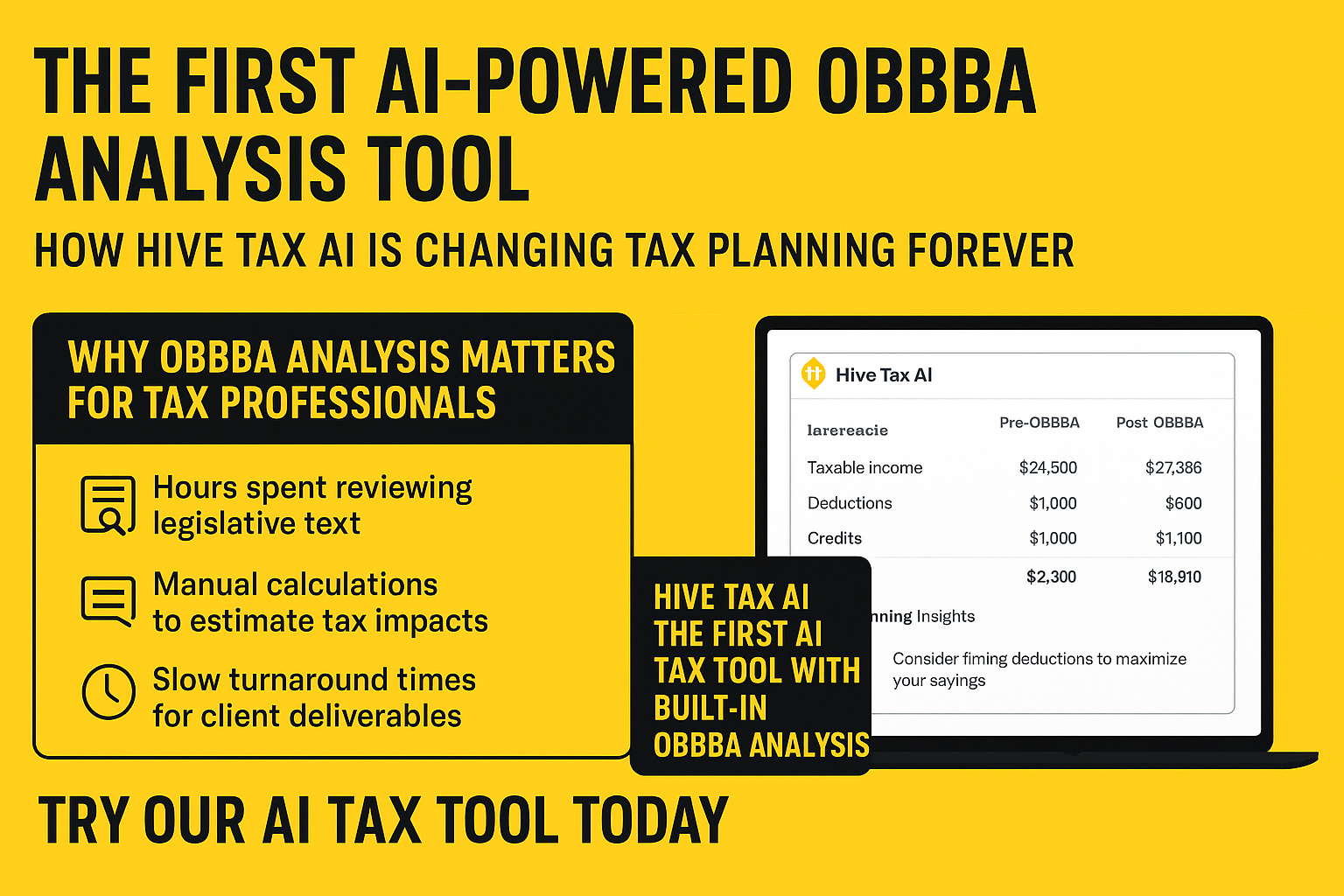

Traditionally, analyzing a major tax law meant:

- Hours spent reviewing legislative text

- Manual calculations to estimate tax impacts

- Slow turnaround times for client deliverables

With OBBBA’s hundreds of provisions, manual analysis isn’t just slow—it’s risky. Missing even one provision could cost a client thousands in taxes.

Hive Tax AI: The First AI Tax Tool with Built-In OBBBA Analysis

Hive Tax AI is the first AI tax research and AI tax planning tool to fully integrate personalized OBBBA analysis. This isn’t a generic tax calculator—it’s an intelligent system built to:

- Interpret the full OBBBA Final Bill

Our team curated and structured the complete legislative text into a machine-readable proprietary OBBBA database, ensuring accuracy and completeness. - Run Client-Specific OBBBA Impact Reports

Upload a tax return, and our AI instantly compares pre-OBBBA and post-OBBBA tax scenarios—showing changes in taxable income, deductions, credits, and overall liability. - Deliver Personalized Tax Strategies

The tool doesn’t just show the numbers—it generates tailored planning recommendations to help clients minimize tax impact under OBBBA.

OBBBA Analysis Directly Inside the AI Tax Research Tool

Most tax tools either focus on research or planning. Hive Tax AI combines both:

- AI Tax Research Tool: Search and get answers with citations from the OBBBA bill, IRS publications, and authoritative sources.

- OBBBA Analysis Engine: Instantly apply those rules to a client’s real data for actionable insights.

This agentic AI in tax approach means:

- No switching between multiple platforms

- Faster client turnaround

- Higher-value advisory services

Example: How the OBBBA Analysis Tool Works

- Upload Client Tax Return – PDF or digital tax file

- AI Runs OBBBA Scenario – Calculates tax outcomes under the new law

- See Side-by-Side Comparison – Taxable income, deductions, credits, total tax, and refund/tax due

- Get Planning Insights – From timing deductions to optimizing credits, based on client-specific numbers

Why Hive Tax AI is a Game-Changer

- First-Mover Advantage: No other platform offers a built-in personalized OBBBA analysis tool.

- Speed & Accuracy: Hours of work reduced to minutes, with detailed accuracy checks.

- Competitive Edge: Empower your firm to advise clients proactively—before competitors even start running numbers.

Final Takeaway

With the OBBBA Final Bill now law, tax professionals can’t afford to delay analysis. Hive Tax AI’s AI-powered OBBBA analysis ensures you can instantly measure the impact, strategize, and communicate changes to clients—without the manual headache.

Try our AI tax tool today or book a free demo and see how AI-driven OBBBA analysis can elevate your advisory services.