The proposed 2025 Child Tax Credit expansion could significantly impact family tax planning. This article breaks down the latest updates, eligibility changes, and refundability thresholds—highlighting how AI tax research tools, AI tax planning tools, and agentic AI in tax can help professionals deliver faster, smarter insights. Stay ahead of policy shifts and serve clients with precision—powered by AI.

The 2025 Child Tax Credit Expansion: Key Updates for Tax Professionals

The Child Tax Credit (CTC) remains a cornerstone of family-focused tax relief. In 2025, lawmakers are pushing for a targeted expansion of the credit—bringing new implications for refundability, phase-in thresholds, and eligibility rules. For CPAs and financial advisors, understanding these nuances is essential. But the real edge comes from leveraging AI tax research and AI tax planning tools to interpret and implement these changes efficiently.

Let’s explore what’s changing and how agentic AI in tax can elevate your planning strategies.

What’s Changing with the Child Tax Credit in 2025?

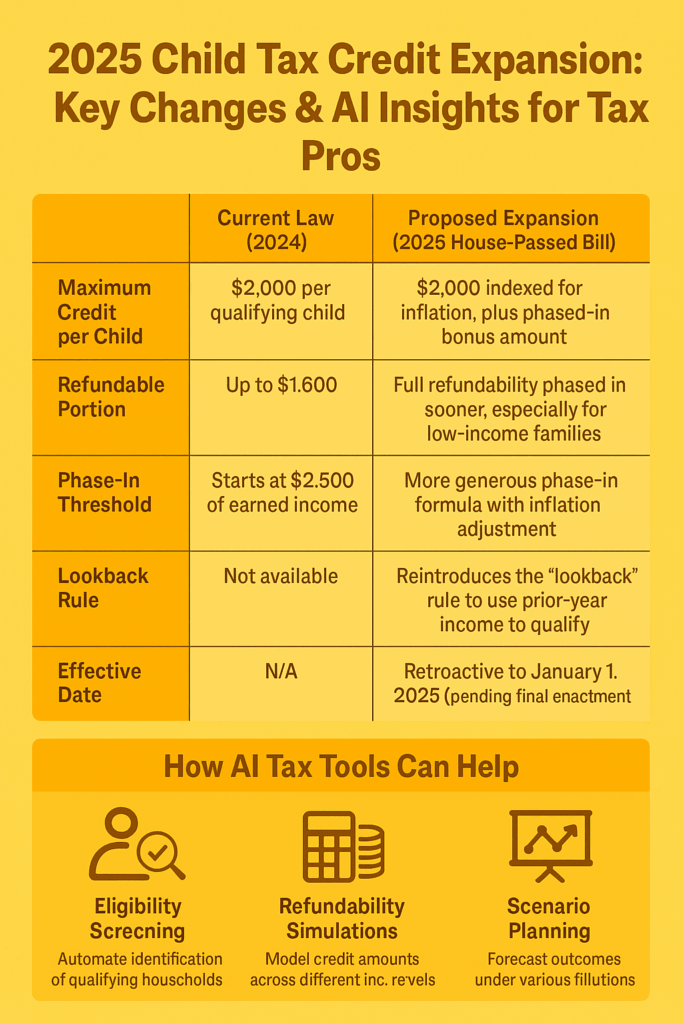

| Provision | Current Law (as of 2024) | Proposed Expansion (2025 House-Passed Bill) |

| Maximum Credit per Child | $2,000 per qualifying child | $2,000 indexed for inflation, plus phased-in bonus amount |

| Refundable Portion | Up to $1,600 | Full refundability phased in sooner, especially for low-income families |

| Phase-In Threshold | Starts at $2,500 of earned income | More generous phase-in formula with inflation adjustment |

| Lookback Rule | Not available | Reintroduces the “lookback” rule to use prior-year income to qualify |

| Effective Date | N/A | Retroactive to January 1, 2025 (pending final enactment) |

How AI Tax Tools and Agentic AI Streamline CTC Planning

Manually calculating CTC eligibility across multiple clients with changing income, dependent status, or filing status can be overwhelming—especially as policy shifts. Here’s where AI tax tools step in.

Use Cases for AI in Child Tax Credit Planning:

- Automated Eligibility Screening: Agentic AI agents can instantly scan client tax returns and flag households qualifying for the expanded credit.

- Refundability Calculations: AI tax planning tools simulate various income thresholds, allowing professionals to model refundable vs. nonrefundable amounts across different scenarios.

- Policy Monitoring: AI tax research systems stay updated with live feeds from IRS bulletins, congressional proposals, and court rulings—so you don’t have to.

- Scenario Planning: Forecast credit amounts under multiple filing options using intelligent agents designed for dynamic tax modeling.

Recommended Tool:

Hive Tax AI offers a suite of integrated tax research and planning features designed for CPAs, including CTC simulations based on proposed and enacted legislation.

Practical Considerations for Tax Pros

- Low-Income Households: Ensure clients with little or no income benefit from the enhanced refundability. Lookback rules may be critical here.

- Year-Round Planning: Mid-year income changes may affect credit qualification. AI tax planning tools can model “what-if” scenarios in real time.

- Client Education: With agentic AI, you can generate client-facing explanations of how changes to the CTC affect their returns—instantly.

Final Thoughts: AI-Powered Planning for a Changing Credit Landscape

The 2025 Child Tax Credit expansion—if enacted—will offer meaningful benefits for many American families, but it also introduces complexity for tax professionals. By adopting AI tax research, AI tax planning tools, and agentic AI in tax workflows, practitioners can stay agile, accurate, and client-focused.

Ready to supercharge your practice with AI?

Explore Hive Tax AI—the smart assistant built for tomorrow’s tax challenges.

Try our AI tax planning tool today or book a free demo and see how you can serve your clients with confidence, accuracy, and speed.