The Section 199A pass-through deduction is set to expire after 2025, creating major implications for millions of small business owners, S corporations, and sole proprietors. In this blog, we break down what’s at stake and how AI tax research and AI tax planning tools—including agentic AI in tax advisory—can help tax professionals and financial advisors prepare for this significant change. Learn what’s coming, what it means for your clients, and how to navigate the sunset with the latest technology. Explore strategic insights now with AI-powered tax planning.

What Is the Section 199A Deduction?

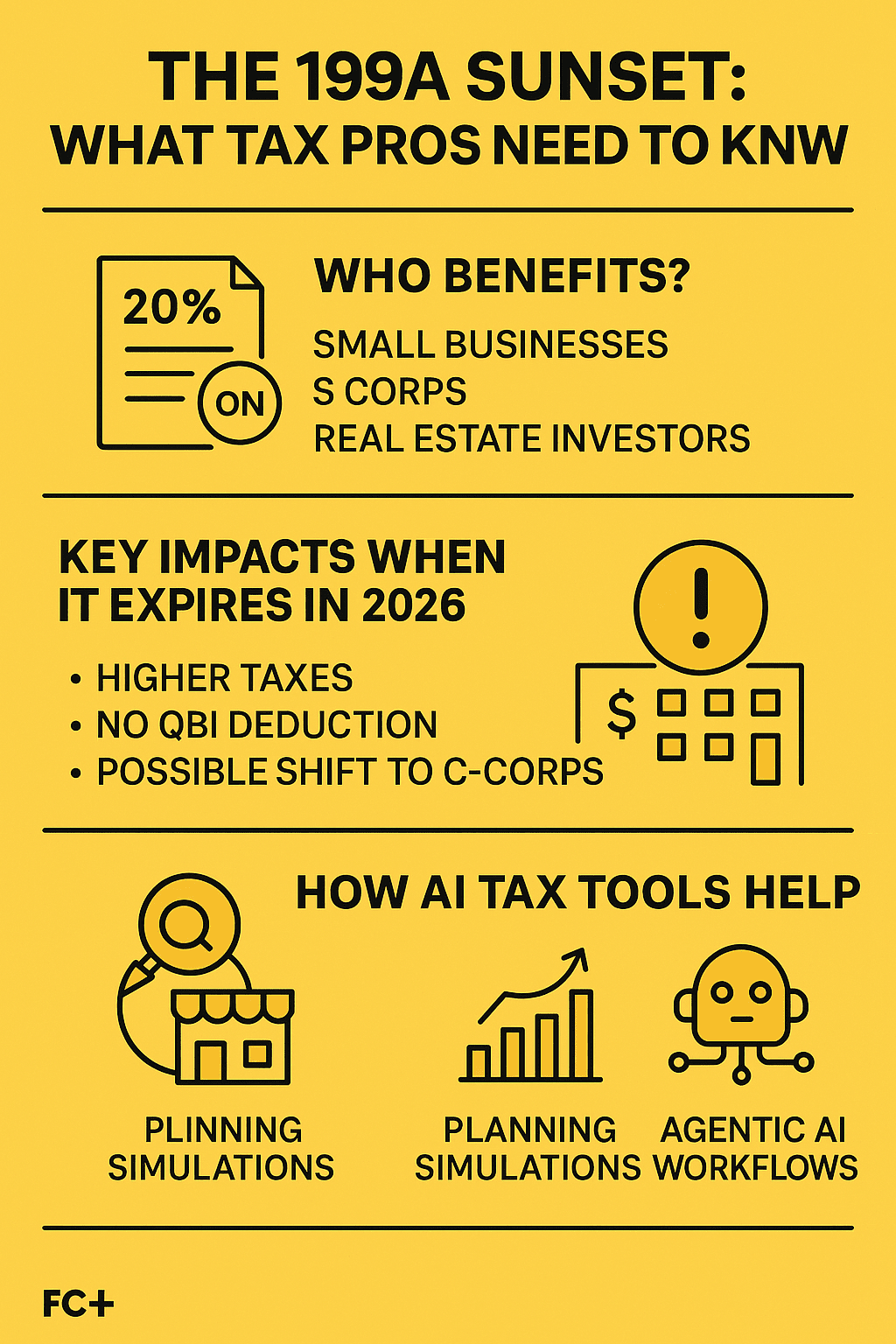

Enacted as part of the Tax Cuts and Jobs Act (TCJA), Section 199A allows qualified pass-through businesses—including sole proprietorships, partnerships, S corporations, and some trusts and estates—to deduct up to 20% of their qualified business income (QBI). This was designed to provide rate parity with the 21% corporate tax rate and offer meaningful tax relief to small businesses.

However, this deduction is scheduled to sunset on December 31, 2025, unless Congress acts to extend it. The repeal would result in a significant tax increase for eligible taxpayers beginning in 2026.

Who Benefits from 199A?

- Small business owners and entrepreneurs

- Real estate investors with REIT dividends or qualified PTP income

- Professionals operating through S corps or LLCs

- Trusts and estates with pass-through income

(Source: IRS QBI Deduction FAQ)

What Happens When Section 199A Expires?

Without an extension, the following key impacts are expected:

| Impact Area | Post-Sunset Effect |

| Qualified Business Income Deduction | Eliminated (20% deduction removed) |

| Effective Tax Rates | Higher marginal tax rates for pass-throughs |

| Entity Structure Planning | Shift toward C-corp conversions may reemerge |

| Trust Planning | Complex trust structures may need re-evaluation |

| Taxable Income | Net taxable income rises, increasing overall tax liability |

How AI Tax Tools Help You Navigate the 199A Sunset

1. AI Tax Research for Complex Scenarios

Use AI tax research tools like Hive Tax AI to quickly search and analyze authoritative sources including:

- IRC §199A provisions

- IRS notices, rulings, and court cases

- Proposed legislative updates

AI-driven insights enable professionals to stay current on potential legislative extensions or reforms.

2. AI Tax Planning Tool for What-If Analysis

Advanced AI tax planning tools can:

- Model different outcomes based on entity structure (S corp vs. C corp)

- Simulate the tax impact of 199A loss

- Recommend Roth conversion strategies, income shifting, or charitable giving to mitigate higher tax brackets

- Optimize owner compensation decisions under post-TCJA conditions

These tools save hours of manual scenario building and help deliver clear, customized plans.

3. Agentic AI in Tax Strategy

Agentic AI—intelligent, autonomous workflows driven by LLMs—can take tax planning to the next level by:

- Proactively scanning returns for 199A exposure

- Alerting advisors to clients at risk post-sunset

- Auto-generating strategic playbooks tailored to income types, entity structure, and jurisdiction

For example, Hive Tax AI’s agentic assistant not only interprets QBI calculations but also recommends strategies such as income splitting, accelerated deductions, or trust restructuring—all within a single workflow.

Action Steps for Advisors and CPAs

As 2026 approaches, proactive planning is crucial. Here’s what you should do now:

- Identify Affected Clients

Use your tax software or AI tools to run a 199A dependency report. - Run Pre-Sunset Scenarios

Use AI tax planning software to simulate 2026 scenarios without the deduction. - Consider Structural Shifts

Evaluate entity conversion, retirement planning, and income smoothing strategies. - Engage in Year-End Planning (2025)

Look for opportunities to accelerate income or defer deductions before 199A sunsets.

Trusted Tools to Get Ahead

- 🔍 Hive Tax AI – AI Tax Research Tool

- 📊 Hive Tax AI – AI Tax Planning Assistant

- 📚 IRS 199A Guidance Hub

Final Thoughts: Don’t Wait for 2026

The expiration of the Section 199A deduction could result in one of the largest tax increases for small businesses in recent memory. Tax professionals and financial advisors must prepare their clients today—not after the deduction is gone. The right AI tax tools and agentic AI in tax planning can turn this challenge into an opportunity to deliver high-value strategic insights.

Try our AI tax planning tool today or book a free demo and see how you can serve your clients with confidence, accuracy, and speed.