The “One Big Beautiful Bill Act” (OBBBA), a comprehensive tax reform package, has passed the U.S. House of Representatives and is currently under Senate consideration. This legislation proposes significant changes to individual and corporate tax structures, social program funding, and international tax policies. Below is a detailed overview of the bill’s key tax provisions, current status, and anticipated next steps.

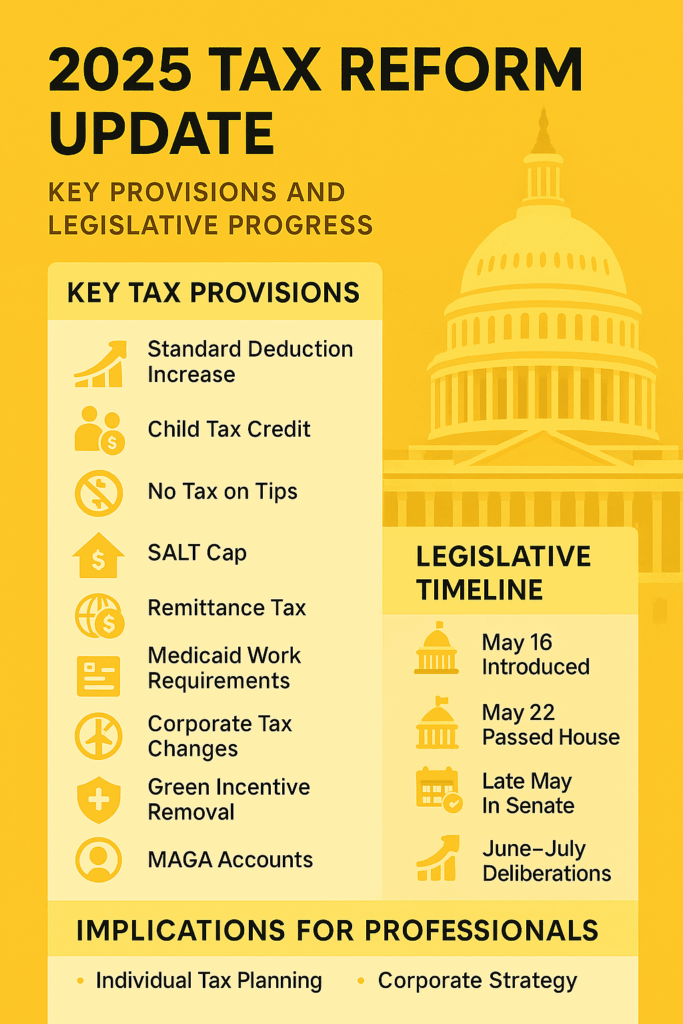

Key Tax Provisions and Legislative Status

| Tax Provision | Description | Status | Next Steps |

| Extension of 2017 TCJA Tax Cuts | Permanently extends individual and corporate tax cuts from the 2017 Tax Cuts and Jobs Act (TCJA), including maintaining the top individual tax rate at 37% and preserving lower rates for Global Intangible Low-Taxed Income (GILTI) and Foreign-Derived Intangible Income (FDII). | Passed House | Awaiting Senate review; potential modifications expected during Senate deliberations. |

| Standard Deduction Increase | Increases standard deduction to $26,000 for joint filers, $19,500 for heads of household, and $13,000 for single filers for tax years 2025–2028. | Passed House | Subject to Senate approval; may be adjusted based on fiscal considerations. |

| Child Tax Credit Expansion | Raises the child tax credit to $2,500 per child through 2028, reverting to $2,000 thereafter. | Passed House | Senate to evaluate the duration and funding of the expanded credit. |

| No Tax on Tips and Overtime | Exempts tips and overtime pay from federal income taxes for workers earning under $160,000, effective through 2028. | Passed House | Senate to consider the provision’s impact on revenue and labor markets. |

| State and Local Tax (SALT) Deduction Cap Increase | Raises the SALT deduction cap from $10,000 to $40,000 for taxpayers with income below $500,000. | Passed House | Senate to assess the provision’s equity and fiscal implications. |

| Remittance Tax Introduction | Implements a 3.5% tax on remittances sent from the U.S. to other countries, excluding U.S. citizens. | Passed House | Senate to deliberate on the potential economic and diplomatic effects. |

| Medicaid Work Requirements | Introduces work requirements for Medicaid recipients and tightens eligibility, potentially reducing coverage for millions. | Passed House | Senate to evaluate the provision’s impact on healthcare access and state budgets. |

| Corporate Tax Provisions | Extends favorable tax rates for GILTI and FDII, maintains the Base Erosion and Anti-Abuse Tax (BEAT) rate at 10.1%, and cancels scheduled increases. | Passed House | Senate to consider international competitiveness and revenue effects. |

| Elimination of Green Energy Incentives | Repeals various green energy tax credits and incentives established in previous legislation. | Passed House | Senate to assess environmental and economic implications. |

| MAGA Savings Accounts | Introduces “Money Accounts for Growth and Investment” (MAGA) savings accounts, providing $1,000 per child to parents for investment purposes. | Passed House | Senate to review the program’s structure and funding mechanisms. |

Legislative Timeline

- May 16, 2025: H.R.1, the “One Big Beautiful Bill Act,” introduced in the House by Rep. Jodey Arrington (R–TX).

- May 22, 2025: Passed in the House with a narrow vote of 215–214–1.

- Late May 2025: Received in the Senate; currently under committee review.

- June–July 2025: Senate deliberations and potential amendments; if passed, the bill will proceed to the President for signing.

Implications for Tax and Financial Professionals

The proposed legislation encompasses significant changes that could impact tax planning and compliance strategies:

- Individual Tax Planning: Adjustments to standard deductions, child tax credits, and exemptions for tips and overtime may affect withholding and estimated tax calculations.

- Corporate Tax Strategy: Extensions of favorable international tax rates and BEAT provisions require reassessment of global tax planning.

- Healthcare Compliance: New Medicaid work requirements necessitate monitoring of client eligibility and potential coverage changes.

- Investment Planning: Introduction of MAGA savings accounts offers new avenues for client investment strategies.

Professionals should stay informed on the bill’s progress and prepare to adjust strategies accordingly.

Resources for Further Information

- Full Text of H.R.1 – One Big Beautiful Bill Act

- House Ways and Means Committee Summary

- Tax Policy Center’s 2025 Tax Cuts Tracker

- IRS 2025 Tax Inflation Adjustments

Conclusion

The “One Big Beautiful Bill Act” represents a comprehensive overhaul of the U.S. tax system, with far-reaching implications for individuals, businesses, and tax professionals. As the bill progresses through the Senate, staying informed and proactive is crucial.

Stay Ahead: Utilize advanced AI tax research and planning tools to navigate these changes effectively. Our AI-driven solutions can help you analyze the bill’s impact on your clients and adapt strategies in real-time.

Explore Our Tools: Ready to transform your practice with agentic AI in tax? Schedule a demo today and experience firsthand how our cutting-edge AI tax tools can revolutionize your approach to tax research and planning.