In the ever-evolving landscape of finance and taxation, accountants, tax preparers, and CPAs face a constant challenge: staying up-to-date with the latest tax codes, providing exceptional client service, and reducing the risk of errors in tax preparation. Furthermore, fewer accounting graduates mean help is becoming harder to find for an ever-increasing workload. As a tax professional, you understand that time is money, and the quality of your service can make or break your business. Fortunately, the world of artificial intelligence (AI) has brought forth a new era of possibilities for accountants, making your job more efficient, accurate, and ultimately, more profitable.

In this article, we will introduce you to the cutting-edge HIVE Tax AI assistants, a trio of AI-powered tools designed to help tax professionals, like you, improve client satisfaction by saving time, responding more quickly, and reducing errors. These tools are the AI Tax Client Support Assistant, AI Tax Research Tool, and AI Financial Planner. Together, they represent the future of accounting and taxation services, making your practice more competitive and client-centric than ever before.

The HIVE Tax AI Assistants at a Glance

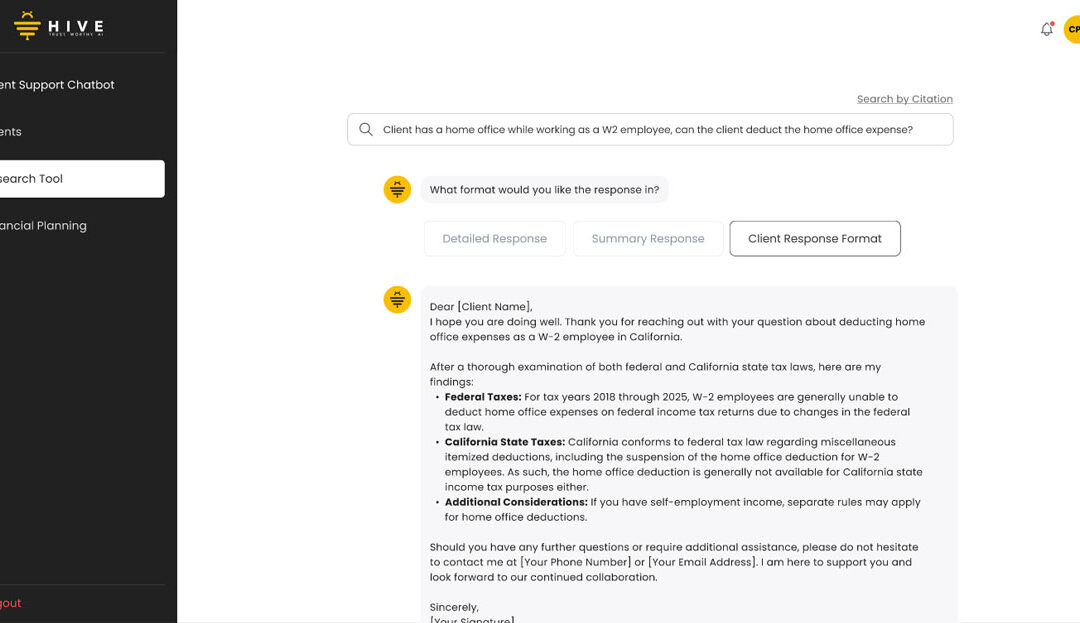

AI Tax Client Support Assistant

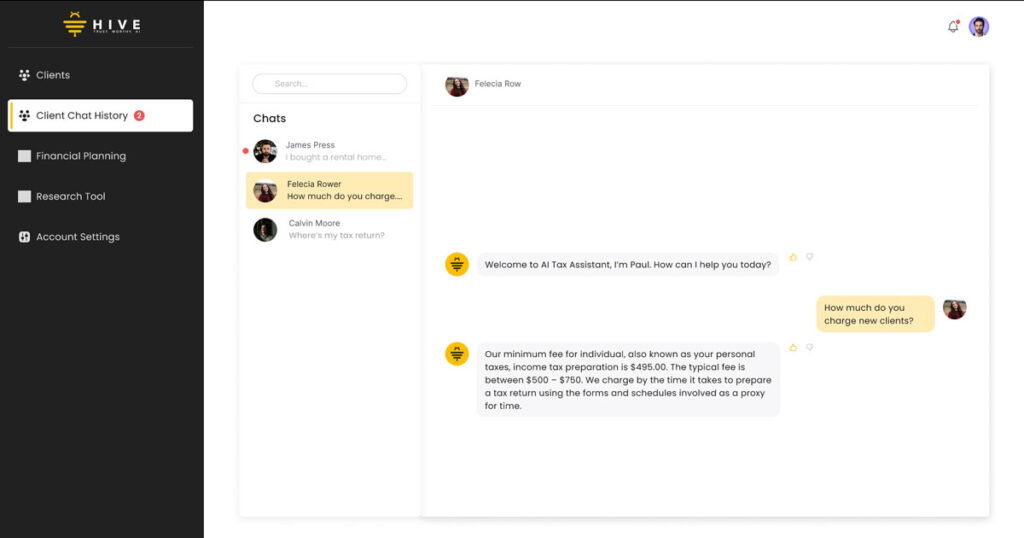

The Client Support Assistant is powered by GPT-4, the latest generation of AI technology. This AI assistant is more than just a chatbot; it is your 24/7 client support team. Here’s what it can do for you:

New Client Interviews and Onboarding: Say goodbye to the tedious process of conducting new client interviews and onboarding sessions. The AI Tax Client Support Assistant can handle this for you efficiently. It collects essential client information, ensuring that you have everything you need to start working on their taxes.

Client Tax Questions: Clients often have questions about their taxes at all hours. Instead of waiting for office hours, they can get instant answers from the AI assistant. It can explain tax concepts, clarify doubts, and provide guidance on tax-related issues.

The beta version of the tax assistant is now available, fill out this form to try it for free:

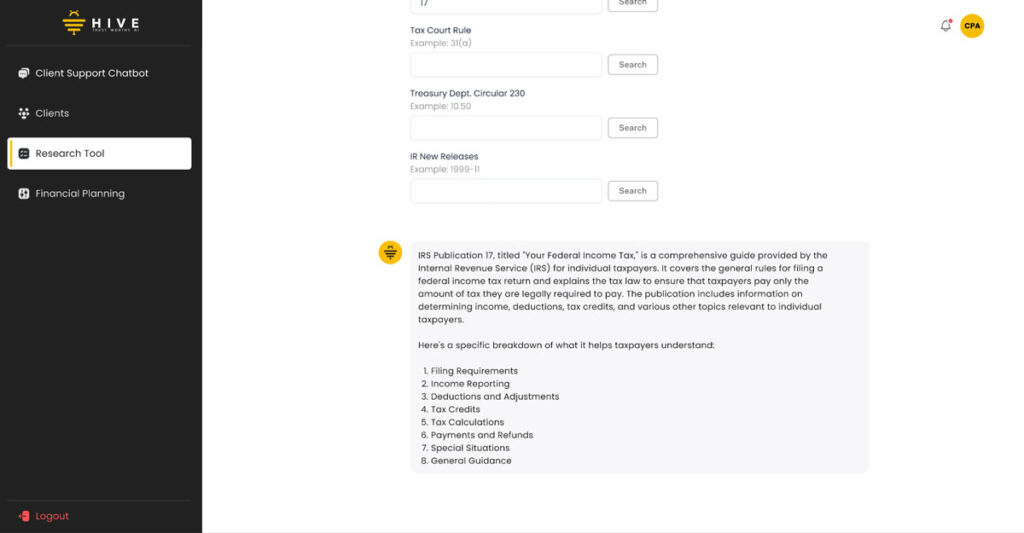

AI Tax Research Assistant: An Internal Tool for CPAs

The HIVE Tax Research Assistant is your AI-powered research partner. It simplifies the complex task of navigating tax codes and regulations, making your research faster and more reliable. Here’s what it offers:

Tax Code Research: Stay updated with the ever-changing tax codes and regulations effortlessly. This assistant can fetch and summarize information from a vast database, ensuring that you are always working with the most current data.

Tax Return Review: Conducting a thorough review of a tax return can be a time-consuming process. This tool allows you to perform a comprehensive review in minutes, ensuring that there are no errors or discrepancies in your work.

Audit Response: In the event of an audit, time is of the essence. The AI Tax Research Assistant can provide you with precise and relevant information to respond to audits quickly and effectively. It significantly reduces the stress and workload associated with audits.

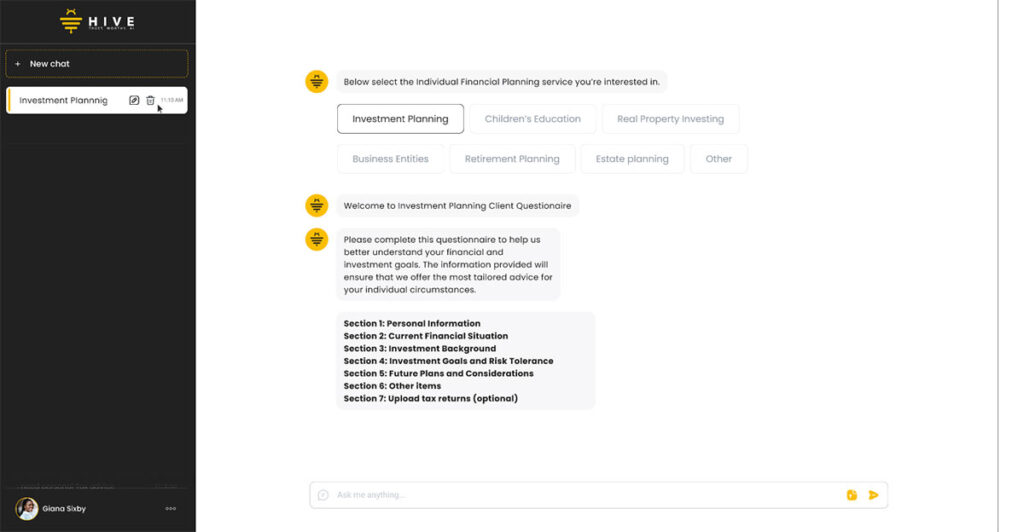

HIVE Tax AI Financial Planning Tool

Financial planning is a valuable service, but it’s often considered an expensive service reserved for high-net-worth individuals. The HIVE AI Financial Planner changes that paradigm, making financial planning accessible to a broader range of clients. It also allows you to expand your business by offering value added services outside of the peak tax season. Here’s what it brings to the table:

Automated Planning: The AI Financial Planner automates the legwork involved in financial planning. It analyzes financial data, goals, and risk tolerance to generate comprehensive planning reports, saving you a significant amount of time.

Customized Reports: The generated reports are highly customizable. You can tailor them to match your client’s unique situation and preferences. The ability to provide personalized reports can set you apart in the marketplace.

Client Presentation: You don’t need to be a financial planning expert to offer this service. The AI Financial Planner does most of the work for you, and all you need to do is review and present the reports to your clients. It’s a time-efficient and value-added service.

The Advantages of HIVE Tax AI Assistants

Now that you’re familiar with the three HIVE Tax AI assistants let’s explore the benefits of these tools:

Saving Time

One of the most precious resources in the accounting world is time. Manual processes like conducting interviews, researching tax codes, and preparing financial plans, can be incredibly time-consuming. The HIVE Tax AI assistants alleviate this burden.

AI Tax Client Support Assistant: Conducting new client interviews can be a significant time sink. The AI Tax Client Support Assistant automates this process, collecting essential client information efficiently. It’s like having an assistant working around the clock, ensuring that you have all the necessary data to start preparing their taxes.

AI Tax Research Assistant: Tax research can be cumbersome, requiring you to sift through extensive legal documents. The Tax Research Tool streamlines this process, fetching and summarizing the relevant information. This not only saves you hours but also reduces the chances of missing important details in the tax code.

AI Financial Planner: Traditional financial planning involves extensive data analysis and report preparation. With the AI Financial Planner, these tasks are automated, enabling you to generate customized planning reports in a fraction of the time it would typically take.

Responding More Quickly

Clients often expect quick responses to their tax-related queries. The HIVE Tax AI assistants help you meet these expectations:

AI Tax Client Support Assistant: This helpful assistant is available 24/7 to provide instant responses. It ensures that your clients never have to wait for answers outside of office hours, enhancing their overall experience.

AI Financial Planner: Financial planning often involves multiple rounds of back-and-forth communication with the client. This tool can provide planning reports quickly, reducing the turnaround time for this service.

Error Reduction

Did you know that up to 60% of professionally prepared taxes contain errors? (link) Even minor mistakes can lead to financial and legal repercussions. AI assistants are designed to minimize the risk of errors:

AI Tax Client Support Assistant: By automating client interviews and onboarding, the AI Tax Client Support Assistant ensures that you have all the necessary client data, reducing the likelihood of errors due to missing information. Moreover, it provides accurate tax advice based on the latest regulations, minimizing the risk of providing incorrect guidance.

AI Tax Research Assistant: This tool not only saves time but also enhances the accuracy of your work. It retrieves information directly from reliable sources, reducing the risk of human error in interpreting complex tax codes.

AI Financial Planner: Automation in financial planning reduces the risk of mathematical errors and ensures that the generated reports are consistent and accurate.

A Competitive Edge in the Market

In a competitive market, setting yourself apart from competitors is crucial. HIVE Tax AI assistants empower you to do just that by offering 24/7 client support, rapid responses to inquiries, and personalized financial planning reports. These unique service features make your practice stand out among those still relying solely on manual processes.

These AI tools significantly enhance efficiency. By automating time-consuming tasks like client interviews, tax code research, and financial planning, they free up your valuable time and resources, allowing you to focus on more critical aspects of your practice. This improves your workflow and enables you to take on more clients.

The AI Financial Planner expands your service offerings. By making financial planning accessible to a broader client base, you can attract new clients and diversify your revenue streams.

HIVE Tax AI assistants also mitigate this risk by providing precise information and automating complex processes. The result is that your clients receive a consistently high level of service.

Finally, by automating tasks and minimizing the potential for errors, HIVE Tax AI assistants can lead to significant cost reductions in your practice. This includes savings on manual labor expenses and the avoidance of potential liabilities stemming from inaccuracies in tax preparation.

Overcoming Concerns and Challenges

As you consider integrating the HIVE Tax AI assistants into your practice, it’s natural to have questions and concerns. Here are some answers to common questions.

Enhanced Data Security

HIVE Tax AI assistants use advanced encryption and security measures to protect sensitive client information. The data is stored securely, and only authorized personnel can access it. You can be confident that your clients’ information is well-protected.

Intuitive and Easy to Learn

Adopting new technology can come with a learning curve. However, the HIVE Tax AI assistants are designed to be intuitive and user-friendly. You’ll receive training and support to help you get the most out of these tools. Once you become accustomed to the AI assistants, you’ll find that they streamline your workflow and make your job more efficient.

Cost

While adopting new technology can have an initial cost, the long-term benefits often outweigh the investment. The HIVE Tax AI assistants can reduce operational costs by automating tasks, preventing errors, and allowing you to serve more clients. They provide a significant return on investment in terms of time savings and increased revenue potential.

The Future of Tax Preparation and CPA Services

In a world driven by technology and declining accounting graduates, the HIVE Tax AI assistants represent the future of tax preparation and CPA services. These AI-powered tools provide an opportunity to excel in your field, offering clients unmatched support, quicker responses, and the utmost in accuracy. They enable you to differentiate your practice, stay competitive, and position yourself as a forward-thinking professional.

The time-saving, error-reducing, and client-satisfying capabilities of the HIVE Tax AI assistants can fundamentally change the way you operate and elevate your practice to new heights. By integrating AI into your work, you’re not just embracing innovation; you’re setting a new standard for the industry.

As technology continues to evolve, the choice is clear: embrace the future with HIVE Tax AI assistants. Try the beta version of the AI Tax advisor today and see how it can answer your client tax questions!