In the ever-evolving world of accounting and taxation, the role of Certified Public Accountants (CPAs) is undergoing a transformation. Thanks to advancements in artificial intelligence (AI), accounting professionals now have access to powerful AI for CPA tools that can streamline their work, improve accuracy, and provide valuable insights.

The Current Landscape of AI for CPAs

AI is already making a significant impact in the field of accounting. Here are some of the key areas where AI tools are being utilized:

1. Data Entry and Extraction: AI-powered software can extract data from various sources, including invoices, receipts, and bank statements. This eliminates the need for manual data entry, reducing the risk of errors and saving time.

2. Automated Bookkeeping: AI-driven bookkeeping software can categorize transactions, reconcile accounts, and generate financial statements, all without human intervention. This allows CPAs to focus on more strategic tasks.

3. Predictive Analytics: AI algorithms can analyze historical financial data to make predictions about future trends and financial outcomes. This helps CPAs provide more proactive advice to their clients.

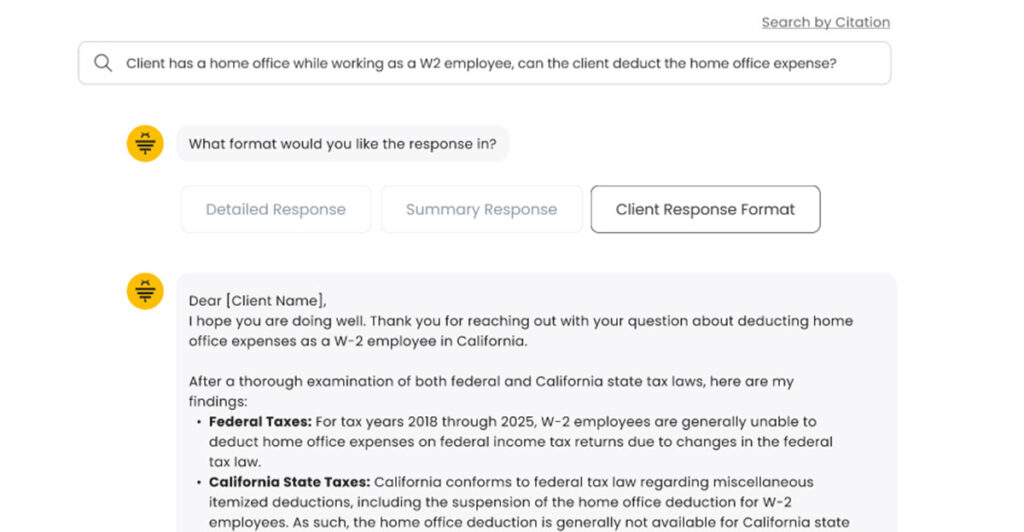

4. Tax Compliance: AI can assist with tax compliance by keeping track of changing tax laws and regulations, ensuring that businesses and individuals remain compliant and minimize their tax liabilities. HIVE Tax AI is releasing a series of tax assistants to help tax professionals with their workloads and better serve their clients.

5. Fraud Detection: AI tools can identify unusual patterns in financial transactions that may indicate fraudulent activity, helping CPAs protect their clients from financial losses.

The Future of AI for CPAs

While AI has already made significant inroads into the world of accounting, the future promises even more exciting developments:

1. Advanced Automation: AI will continue to automate routine accounting tasks, allowing CPAs to focus on higher-level strategic advisory services. This will enhance the value CPAs bring to their clients.

2. Enhanced Decision Support: AI will become better at providing real-time insights and recommendations, enabling CPAs to make informed decisions quickly.

3. Natural Language Processing (NLP): NLP capabilities will improve, making it easier for CPAs to interact with AI systems using everyday language, facilitating more efficient communication and data retrieval.

4. Greater Personalization: AI will help CPAs tailor their services to individual clients’ needs, providing customized financial solutions and advice.

5. Risk Management: AI will play a crucial role in identifying and mitigating financial risks, allowing CPAs to protect their clients’ assets more effectively.

Artificial Intelligence is reshaping the accounting profession, offering CPAs and tax professionals an array of powerful tools to streamline their work. It also provides more valuable insights to their clients. As AI continues to evolve, CPAs who embrace these technologies will be well-positioned to thrive in a rapidly changing industry.