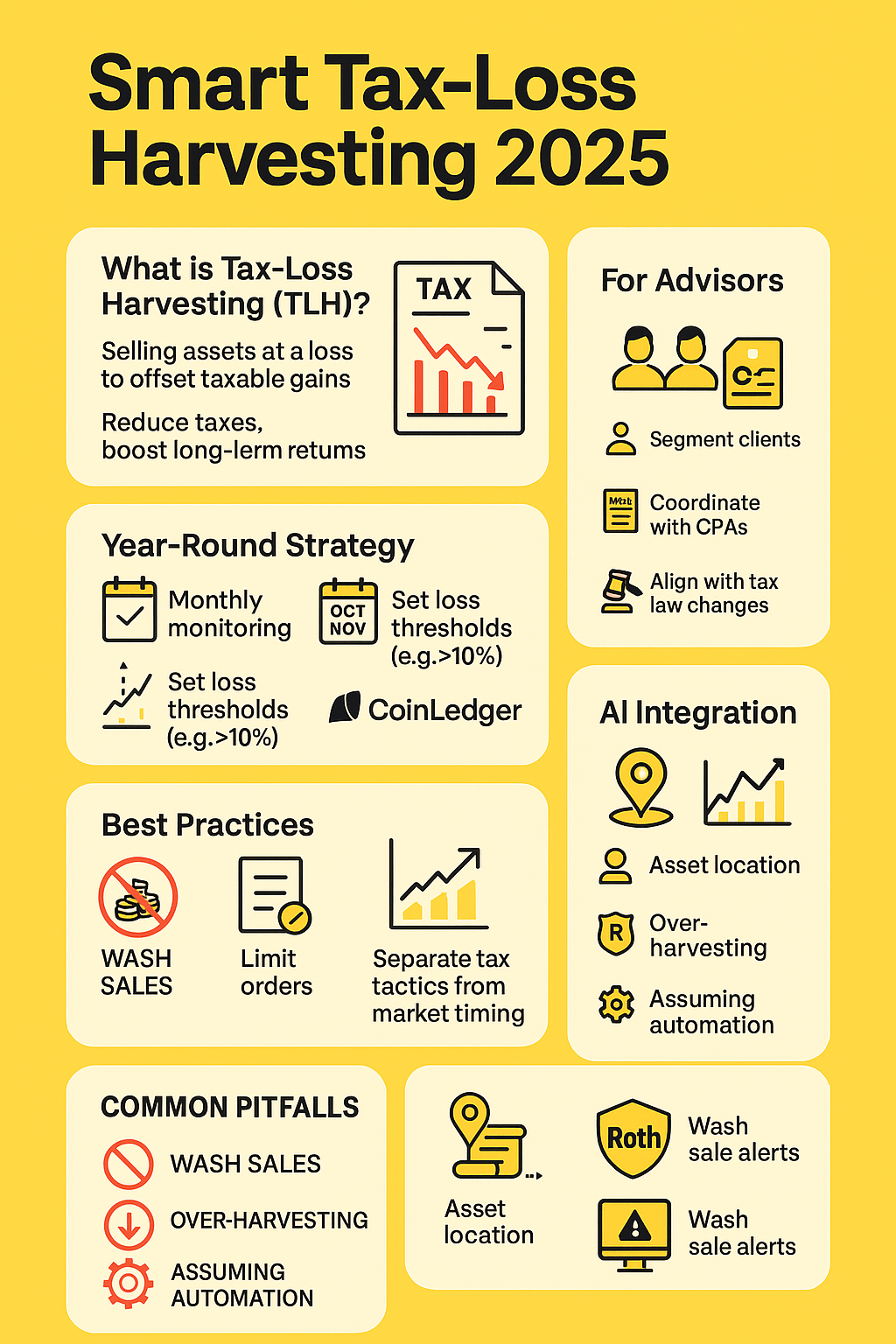

Tax-loss harvesting (TLH) is a powerful yet underutilized strategy to reduce tax liability and enhance long-term portfolio returns. This guide shares best practices, tools, and advisor insights to implement effective TLH using AI tax tools, automated platforms, and direct indexing. Whether you’re an individual investor or a financial advisor, leverage these insights to avoid costly pitfalls and integrate TLH into a broader AI tax planning strategy. Take advantage of smart automation and agentic AI in tax to boost your after-tax performance—year-round.

Year-Round Harvesting and Timing Matters

Avoid December rushes. Optimize tax outcomes year-round.

- Monitor Regularly: Use monthly or quarterly reviews—or automated tools—to identify “ripe” losses early.

- Don’t Wait for Year-End: October and early November are often better harvest windows than December.

Set Thresholds: Manually or through algorithms (e.g. >10% loss), automate consistent TLH behavior.

Top Tools to Power Your Tax-Loss Harvesting

Use platforms and AI tax tools that make TLH seamless.

1. Robo-Advisors with TLH Features

- Examples: Betterment, Wealthfront, Schwab Intelligent Portfolios, Fidelity Go

- Benefit: Continuous, automated harvesting with wash-sale avoidance

- Best for: Individual investors who want a “set-it-and-forget-it” approach

2. Direct Indexing Platforms

- Providers: Schwab Personalized Indexing, Vanguard Personalized Indexing, Parametric, Aperio

- Benefit: Stock-level harvesting for deeper loss opportunities

- Best for: High-net-worth clients with $100K+ in taxable portfolios

3. Portfolio & Tax Tracking Tools

- Platforms: CoinLedger, Koinly (for crypto), advisor software like Tamarac, Orion

- Must-Have: Enable specific lot identification to target the biggest losses

Tip: Use tools that flag loss opportunities across multiple accounts

Execution Best Practices

Optimize trades for tax results—without disrupting your investment strategy.

- Harvest Losses, Not Outlooks: TLH is a tax tactic, not a market timing move.

- Use Tax Lot Selection Wisely: Maximize losses using HIFO (highest-in, first-out).

Watch Transaction Costs: Use limit orders or chunk trades for large, less liquid positions.

Common Pitfalls to Avoid

Avoid these mistakes that could cost you the benefit of TLH.

❌ Wash Sale Violations

- Occur if you buy the same or “substantially identical” security 30 days before/after a sale.

- Includes repurchases in IRAs or spouse accounts—coordinate closely across accounts.

❌ Not Harvesting at All

- Loss aversion stops many from realizing value. Remember: selling low and rebuying smartly = tax win.

❌ Over-Harvesting Small Losses

- Focus on material losses (e.g., $500+ or 5%) to avoid tax prep clutter and over-trading.

❌ Assuming Automation Is Enabled

- Always verify with your advisor or platform that TLH is turned on and working.

❌ Ignoring the $3,000 Ordinary Income Limit

If you’re not realizing gains, TLH benefit may be limited to $3K/year. Plan gain harvesting accordingly.

Advisor-Specific TLH Guidance

For financial professionals using AI tax tools and platforms.

- Segment Clients by Needs: High-net-worth = continuous monitoring; others = periodic review or robo.

- Educate Clients: Explain the why behind TLH to avoid confusion (“Why are you selling at a loss?”).

- Coordinate with CPAs: Know client’s capital gains ahead of time; align TLH activity with tax planning.

- Use Advisor Platforms: Leverage rebalancing tools with TLH modules (Tamarac, Orion, LifeYield, Smartleaf).

Factor in 2025 Tax Law Changes: Sunset of TCJA and rate shifts could affect harvesting timing.

TLH + AI Tax Planning = Tax Alpha

Tax-loss harvesting is just one piece of the puzzle.

When integrated into a broader AI tax planning tool or platform, TLH works alongside strategies like:

- Asset location optimization

- Gain harvesting in 0% tax years

- Roth IRA conversion planning

- Portfolio rebalancing and wash sale monitoring via agentic AI in tax

Explore how modern AI tax research platforms can integrate these strategies into automated, personalized plans for your clients or portfolio.

Final Thoughts

Tax-loss harvesting, when done well, creates real tax alpha without changing your investment thesis. With the help of AI tax tools and agentic AI in tax workflows, TLH can be seamlessly embedded into year-round portfolio management.

→ Want to see how Hive Tax AI helps advisors and investors execute TLH with confidence and automation? 👉 Book a demo with Hive Tax AI