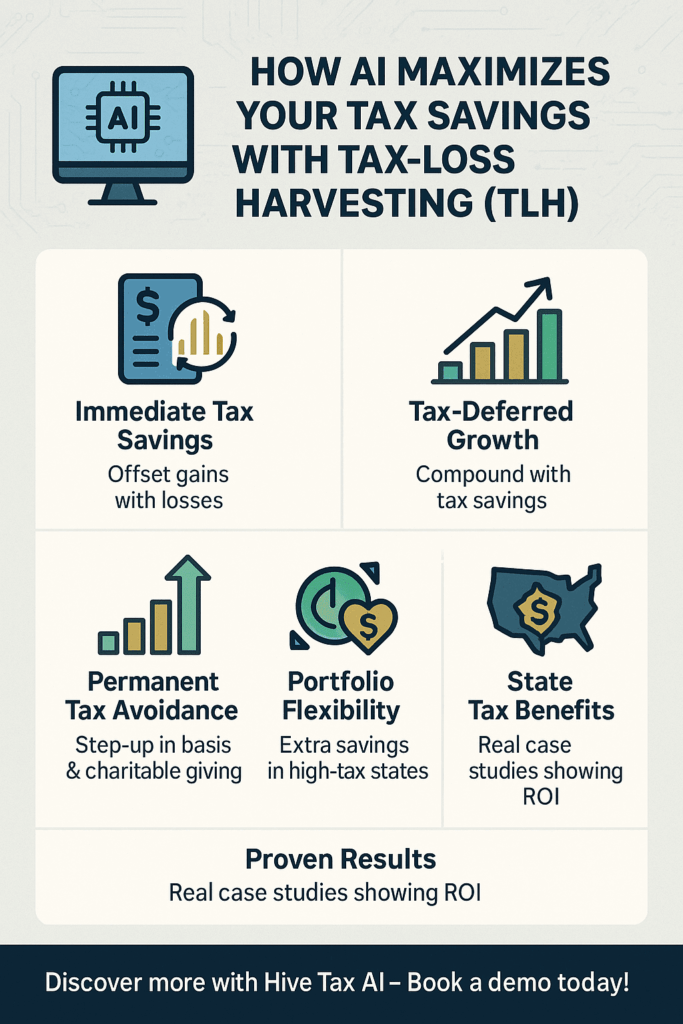

Discover how AI tax tools and advanced AI tax planning techniques, including tax-loss harvesting (TLH), can significantly boost your after-tax investment returns. Learn about immediate tax savings, tax-deferred growth, permanent tax avoidance strategies, and state tax benefits.

Tax-loss harvesting (TLH) isn’t just about offsetting your gains—it’s a powerful, strategic tool for improving your long-term financial health. Leveraging advanced AI tax planning tools can maximize these benefits for investors and financial professionals.

Key Benefits of AI-Enhanced Tax-Loss Harvesting:

1. Immediate Tax Savings (Lower Current Tax Bill)

AI tax tools quickly identify optimal harvesting opportunities. Losses directly offset your taxable capital gains, dollar-for-dollar, significantly reducing or even eliminating current-year tax liabilities. For instance, harvesting $10,000 of losses could save you approximately $2,200 at a 22% tax bracket on short-term gains, or $1,500 on long-term gains.

2. Tax-Deferred Growth (Compounding Advantage)

TLH defers taxes, providing substantial long-term benefits. AI-driven strategies help investors reinvest immediate tax savings, effectively using government-provided “interest-free loans.” As Vanguard highlights, reinvesting tax savings significantly amplifies financial outcomes over time, creating what’s often termed “tax alpha.”

3. Permanent Tax Avoidance Possibilities

AI tax planning tools identify opportunities to defer taxes indefinitely—or even permanently:

- Step-up in Basis: At death, heirs receive a stepped-up cost basis, eliminating capital gains taxes on accumulated growth.

- Charitable Giving: Donate appreciated assets directly to charity, leveraging harvested losses to offset other taxable income or gains.

These strategies enable tax-efficient generational wealth transfer and charitable contributions, often reducing the tax liability to zero.

4. Enhanced Portfolio Management Flexibility

Tax-loss harvesting empowers strategic portfolio rebalancing without significant tax consequences. AI tax tools facilitate selling appreciated positions or high-risk assets, offsetting gains with harvested losses. Investors gain the flexibility to manage risk, rebalance effectively, and pursue better-performing investments without a hefty tax bill.

5. Additional State Tax Benefits

Many states align their capital gains tax laws with federal rules, multiplying TLH’s benefits. High-tax state residents, such as those in California or New York, especially benefit from AI tax planning strategies that optimize both federal and state tax savings.

6. Proven Real-World Results

Automated and systematic AI-driven TLH can significantly enhance returns. Robo-advisors and automated platforms have consistently demonstrated measurable tax benefits—boosting annual after-tax returns by a meaningful percentage and delivering substantial financial value over time.

Case Studies Highlighting TLH Effectiveness:

- High-Net-Worth Investors (Volatile Market): In 2020, a high-net-worth client using direct indexing captured losses amounting to 25% of their portfolio, saving approximately 10% of their portfolio’s total value in taxes—over $100,000 in direct savings.

- Mid-Level Investors (Automated TLH): In 2022, automated TLH tools at firms like Schwab Intelligent Portfolios captured losses representing over 15% of a client’s account value, seamlessly offsetting gains and significantly reducing the investor’s tax liability.