In a world where technology seems to be advancing faster than we can update our smartphones, it’s no surprise that even the world of finance and taxation is being touched by the digital revolution. Picture this: you sit down to do your taxes, but instead of sifting through a mountain of paperwork and endless forms, you simply engage in a lively conversation with your Artificial Intelligence (AI) tax advisor. Yes, it might sound like something out of a sci-fi movie, but it’s closer to reality than you think! Today, we’ll explore the exciting possibilities and surprising benefits of working with an AI tax advisor, both from a professional tax preparer’s standpoint and the perspective a general taxpayer.

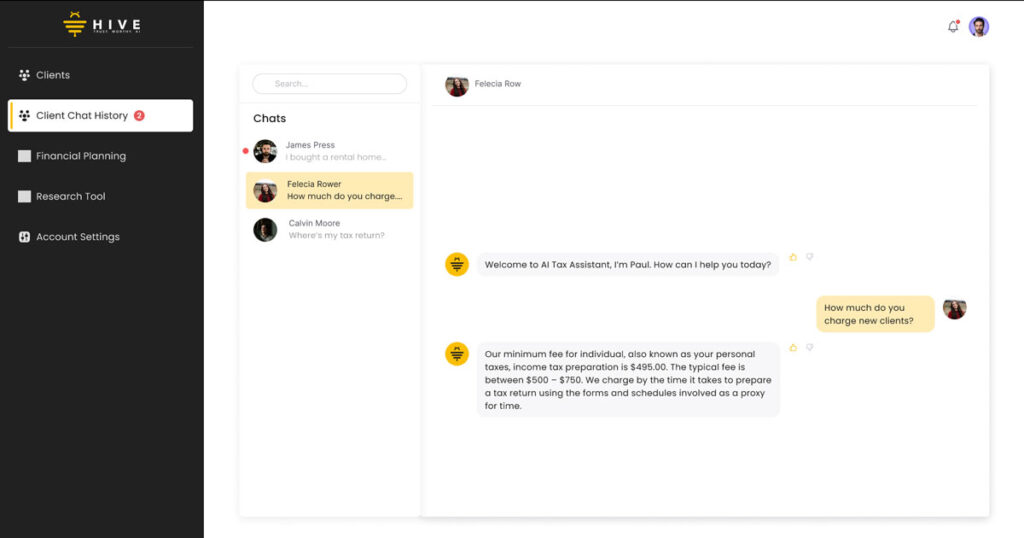

Try the HIVE AI Tax Advisors!

Free to try, no strings attached. We’d love your feedback.

The Tax Pro’s Perspective: A Partnership of Expertise

For tax professionals, the idea of collaborating with an AI tax advisor might initially seem like a threat to job security. However, in reality, it’s more like having a brilliant assistant who never gets tired, always stays updated on tax regulations, and never makes calculation errors.

1. Time Efficiency

Tax professionals are often swamped during tax season, juggling multiple clients and deadlines. An AI tax assistant can handle low-level tasks like data entry, calculations, and document organization. This frees up the tax pro to focus on more complex aspects of tax planning and strategy.

2. Accuracy

Let’s face it, even the most meticulous humans can make mistakes. AI tax bots, on the other hand, are designed to be error-free, ensuring that calculations are precise and in line with the latest tax laws and regulations.

3. Data Analysis

Software with artificial intelligence can quickly analyze vast amounts of financial data to identify trends and anomalies. This helps professional tax preparers provide more insightful advice to their clients. This data-driven approach can lead to better tax planning and savings.

4. Client Engagement

With an AI assistant handling the nitty-gritty details, CPAs can spend more time building relationships with their clients, providing personalized advice, and discussing financial strategies that align with their long-term goals.

A Taxpayer’s Perspective: Simplifying the Tax Filing Process

Now, let’s shift our focus to the perspective of the everyday taxpayer. Dealing with taxes can be a headache, and for many, it’s a source of stress and confusion. Here’s how an AI tax advisor can change the game:

1. User-Friendly Interface

Interacting with an AI tax advisor can be as simple as having a chat or using a user-friendly app. No need to decipher complicated forms or worry about making errors—AI guides you through the process in plain language.

2. Real-Time Advice

Imagine having access to tax advice 24/7. Whether you’re considering a major financial decision or just need a quick answer to a tax-related question, your AI advisor is there to help, offering instant insights and recommendations. It doesn’t matter if it’s 11 o’clock at night or 5 am in the morning. The AI assistant is available to answer your questions.

3. Maximized Deductions

AI can sift through your financial history and identify potential deductions and credits you might have missed. This means more money saved and less stress during tax season.

4. Effortless Record-Keeping

Your AI advisor can help you organize and store financial documents electronically, making it easier to keep track of your financial history and prepare for future tax filings.

5. Cost Savings

By reducing the need for extensive manual labor, AI tax advisors can also help lower the cost of tax preparation services, making expert tax advice more accessible to a wider audience.

The concept of working with an AI tax advisor is not just a futuristic fantasy but a real and promising development in the world of taxation. For professional tax preparers, it enhances their capabilities and efficiency, allowing them to provide even better service to their clients. For general taxpayers, it simplifies the tax-filing process, maximizes savings, and reduces the stress associated with taxes. While AI might not replace human expertise entirely, it’s certainly poised to revolutionize the way we handle our finances and taxes. So, get ready for a tax season that’s not just stress-free but downright enjoyable with your AI tax advisor by your side!

How Does HIVE Tax AI Fit Into this Picture?

HIVE Tax AI assistants are emerging as a transformative force in the realm of taxation, catering to the needs of both professional tax preparers and general taxpayers. It offers a seamless partnership that enhances tax prep efficiency. HIVE assistants take care of routine tasks, ensure error-free calculations, and empower professionals to focus on providing clients with more personalized, data-driven advice. With the help of HIVE Tax AI, tax professionals can build stronger client relationships and streamline their workflow during tax season.

For general taxpayers, HIVE Tax AI simplifies the tax-filing process, making it more user-friendly and accessible. They can engage with the AI through easy-to-use interfaces, receive real-time assistance, and enjoy peace of mind knowing they’re maximizing their deductions and credits. Furthermore, HIVE Tax AI encourages efficient record-keeping, helping taxpayers stay organized and prepared for future filings. Its affordability ensures that expert tax advice is within reach for individuals from all walks of life.

HIVE Tax AI serves as a bridge that brings together the expertise of tax preparers and the needs of general taxpayers. It introduces efficiency, accuracy, and convenience into the world of tax advising, promising a brighter, stress-free future for everyone involved. With HIVE, tax season no longer needs to be a source of dread but rather an opportunity for seamless collaboration and financial empowerment.