Freelancing offers flexibility and independence—but come tax season, it also brings a unique set of challenges. As a freelancer, you’re considered self-employed by the IRS, which means you’re responsible for tracking income, estimating taxes, and identifying every legitimate deduction to reduce your tax bill.

In this comprehensive 2025 guide, we’ll break down the top tax deductions for freelancers, explore how AI tax tools are transforming tax filing, and highlight how AI tax research can help you avoid costly mistakes.

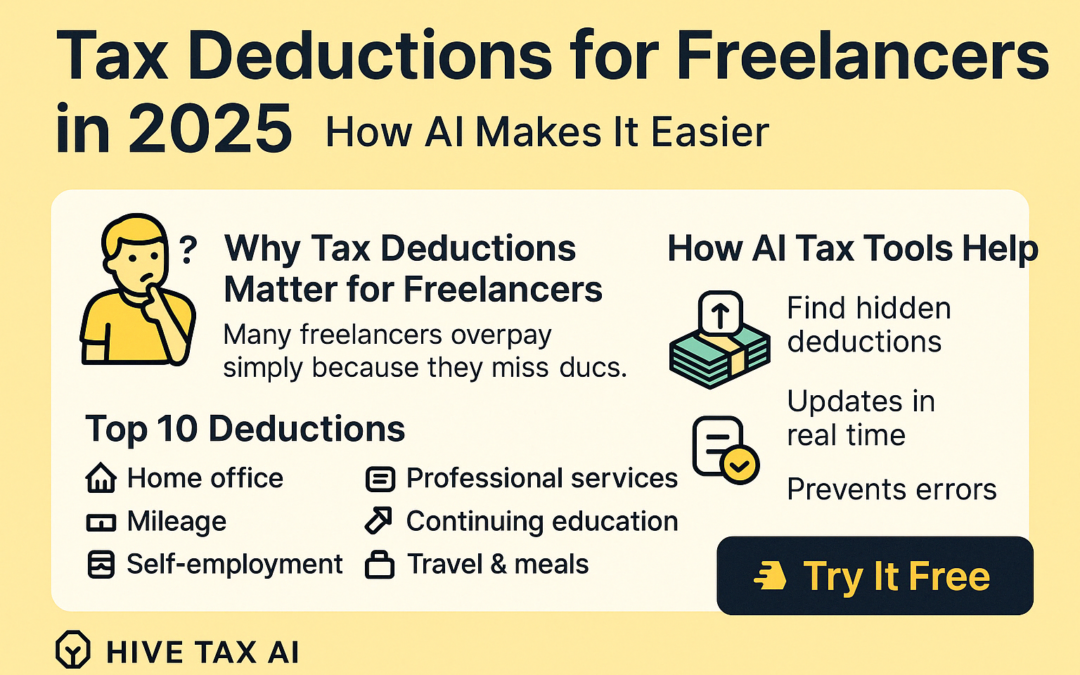

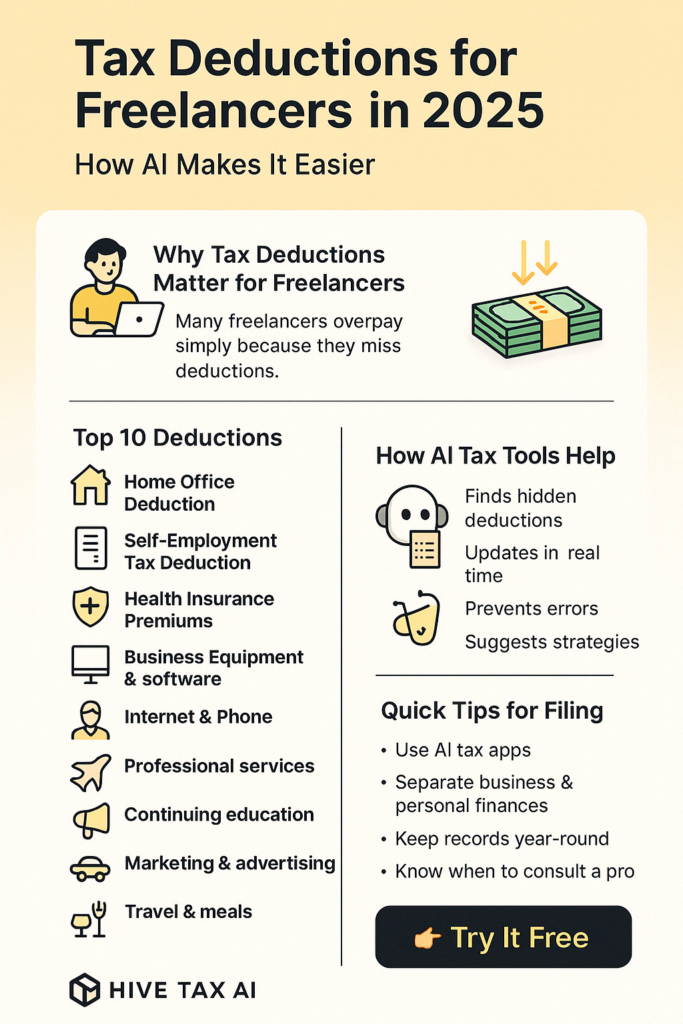

Why Tax Deductions Matter for Freelancers

Tax deductions reduce your taxable income, potentially saving you thousands of dollars each year. As a freelancer, you’re allowed to deduct ordinary and necessary business expenses that are directly related to your work.

But many freelancers overpay taxes simply because they don’t know what they can write off—or they miss deductions due to poor recordkeeping or confusing rules.

That’s where AI tax research tools come in. These technologies make it easier than ever to stay compliant, discover deductions you might overlook, and file with confidence.

Top Tax Deductions Freelancers Should Know in 2025

1. Home Office Deduction

If you use part of your home regularly and exclusively for business, you may qualify for this deduction. You can choose between:

- Simplified method: $5 per square foot, up to 300 sq ft.

- Actual expense method: Deduct a percentage of actual costs (mortgage/rent, utilities, insurance, etc.).

📌 IRS Source: Topic No. 509 – Business Use of Home

2. Self-Employment Tax Deduction

Freelancers must pay both the employer and employee portions of Social Security and Medicare taxes. However, you can deduct the employer-equivalent portion (50%) on your tax return.

📌 IRS Source: Self-Employment Tax (Schedule SE)

3. Health Insurance Premiums

If you’re self-employed and not eligible for an employer-sponsored plan, your health insurance premiums (including dental and long-term care) may be deductible.

📌 IRS Source: Publication 535 – Chapter 6, Insurance

4. Business Equipment and Software

Laptops, phones, tablets, cameras, and even software subscriptions like design tools or accounting platforms can be deducted if used for work.

Don’t forget to deduct your subscription to AI tax research platforms or AI-driven accounting tools used to streamline your tax prep.

📌 IRS Source: Publication 946 – How to Depreciate Property

5. Internet and Phone Expenses

You can deduct the business-use percentage of your internet and phone bills. If you work from home, this adds up fast.

📌 IRS Source: Publication 535 – Utilities

6. Professional Services

Did you hire a virtual assistant, editor, lawyer, or tax consultant? These are considered business expenses.

Freelancers who invest in AI tax tools for tax planning or filing can also deduct the cost of those services.

📌 IRS Source: Publication 535 – Legal and Professional Fees

7. Continuing Education

Courses, webinars, and certifications related to your freelance work are deductible—so are books, subscriptions, and professional memberships.

📌 IRS Source: Publication 970 – Education Expenses

8. Marketing and Advertising

This includes website costs, email marketing tools, social media ads, and even printed flyers or business cards.

📌 IRS Source: Publication 535 – Advertising

9. Travel and Meals

Travel related to client meetings, conferences, or business projects can be partially deductible. So can meals if they are for business purposes.

📌 IRS Source: Publication 463 – Travel, Gift, and Car Expenses

10. Depreciation

If you purchased expensive equipment that lasts longer than a year, you might deduct it over time using depreciation.

📌 IRS Source: Publication 946 – How to Depreciate Property

Why AI Tax Research Matters in 2025

Tax laws evolve constantly. For 2025, freelancers face new challenges from potential changes in deductions, filing thresholds, and reporting requirements (especially for digital payments and 1099-K forms).

AI tax research tools give you real-time insights into the latest IRS rules, case law, and deduction eligibility—so you’re always filing with the most up-to-date information.

Final Tips for Freelancers Filing Taxes in 2025

- Track your expenses year-round using AI-powered apps or spreadsheets.

- Separate business and personal finances with a dedicated bank account.

- Use AI tax tools that can analyze your return and suggest strategies for next year.

- Consult a tax professional if your situation is complex or you’re unsure about a deduction.

Ready to Make Tax Season Easier?

At Hive Tax AI, we’re building cutting-edge AI tax tools designed for tax professionals just like you. Our platform helps you uncover deductions, minimize tax liability, and file with confidence—without spreadsheets or guesswork for your clients

Explore how our AI tax research tool can support your unique freelance journey in 2025 and beyond.