Treating your cryptocurrency activities as a bona fide business—not just a personal hobby—can unlock significant tax savings. This strategy is especially valuable for crypto miners, validators (stakers), and active traders. When your crypto activity rises to the level of a trade or business, you can report income and deduct ordinary and necessary business expenses, such as equipment, electricity, internet, software, and professional fees, on Schedule C (or a business return if incorporated) .

Key advantages:

- Lower taxable income through business deductions

- Eligibility for the 20% Qualified Business Income (QBI) deduction

- Ability to offset other income if expenses exceed business income

However, running your crypto operation as a business also means you’ll pay self-employment tax on net profits and need to comply with business tax filing requirements. The main challenge: proving your crypto activity is genuinely a business in the eyes of the IRS .

How It Works

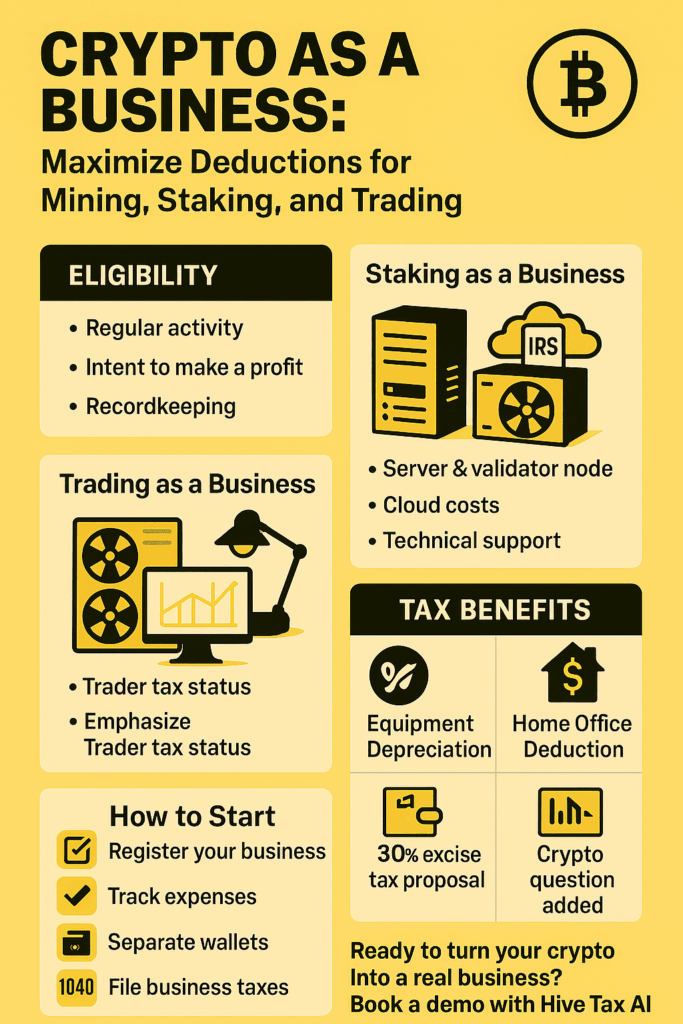

Mining as a Business

If you mine cryptocurrency, the IRS treats the value of mined coins as ordinary income at the time you receive them . Hobbyist miners report income with no deductions. But if you’re running a mining business—even as a sole proprietor—you can deduct major expenses:

- Mining rigs & hardware (purchase and depreciation)

- Electricity and cooling costs

- Repairs and maintenance

- Internet and home office allocation

If your expenses exceed mining income, you may claim a business loss (with certain limitations) and offset other income sources. Note that mining business income is subject to self-employment tax (15.3%) .

Staking as a Business

IRS Revenue Ruling 2023-14 clarified that staking rewards are taxable as ordinary income when you gain control over the coins . If you run a staking operation as a business—such as operating validator nodes—you can deduct costs for:

- Server hosting and cloud infrastructure

- Technical support

- Pro-rata home office or rent

Casual stakers rarely qualify, but business stakers can maximize deductions and minimize their taxable net.

Trading as a Business

Frequent, continuous crypto trading may qualify for “trader tax status.” If so, you may be able to deduct trading-related business expenses (hardware, subscriptions, home office, etc.) on Schedule C. Most crypto investors, however, are considered investors, not traders—so this is a high bar to clear .

Note: Mark-to-market accounting under IRC Section 475 is generally not available for crypto, as it is not classified as a security for tax purposes, but business traders can still deduct expenses.

What’s New in 2025

- Mining Deductions & Proposed Excise Tax: For 2025, mining expenses remain deductible, but watch for policy changes. A proposed 30% excise tax on mining electricity (Digital Asset Mining Energy excise tax) was introduced in 2024 but is not yet law .

- Staking Guidance: The IRS’s Revenue Ruling 2023-14 provides clarity—staking rewards are taxed at receipt, and you must report income in the year received. Many exchanges may now issue 1099-MISC forms for staking rewards over $600.

- Trader Status: The IRS now explicitly asks about digital assets on Form 1040. Wash sale rules do not apply to crypto (as of 2025), but business expenses for active traders remain deductible if you meet the trader status requirements.

How to Apply the Strategy

- Establish the Business:

Decide if your crypto activities are regular, continuous, and profit-driven enough to qualify as a business. Register as a sole proprietorship or LLC if appropriate, and get an EIN if needed. - Separate Your Finances:

Use separate wallets and bank accounts for business crypto activities to track income and expenses cleanly. - Maintain Detailed Records:

Keep receipts and logs for all expenses (electricity, hardware, internet, cloud services, trading tools, etc.). - File Schedule C (or Business Return):

Report income and deductible expenses on your business return. Use proper depreciation for hardware via Section 179 or bonus depreciation. In 2025, bonus depreciation phases down to 40% . - Pay Estimated Taxes:

Remember to pay quarterly estimated self-employment and income taxes on your net profit. - Consider Trader Status (If Eligible):

Only high-frequency traders qualify. Consult a tax pro for Section 475 mark-to-market election rules. - Consult a Crypto-Savvy CPA:

The distinction between hobby and business is nuanced. Frequent losses without a profit motive may cause the IRS to reclassify your activity as a hobby, disallowing deductions .

Tax Benefits of Running Crypto Operations as a Business

- Deduct major expenses (equipment, electricity, rent, etc.)

- Depreciate hardware for upfront tax savings

- Offset net losses against other income (subject to limitations)

- Potential QBI deduction of up to 20% on net profit

- Home office and other business deductions further lower taxable income

Example: A crypto miner with $10,000 in mining income and $8,000 in expenses is taxed only on $2,000 profit—saving thousands compared to hobby treatment.

Case Studies

Mining:

John mines crypto in his garage, earning $6,000. With $2,000 in electricity and $1,500 depreciation, he reports just $2,500 net profit, saving over $500 in taxes versus hobby treatment.

Staking:

Sarah runs validator nodes earning $10,000 in staking rewards. With $3,500 in hosting and support costs, her taxable profit is only $6,500. She saves $840 in taxes at a 24% bracket and still benefits from other business deductions.

Trading:

Mike is a professional trader with $50,000 net gains and $10,000 in trading expenses. Deducting those expenses as a business reduces his total taxable income and may allow for QBI deduction if structured properly.

Recommended Tools and Resources

- CryptoTaxCalculator and Koinly — For tracking mining, staking, and trading income and expenses

Koinly Crypto Tax Guide 2025

CryptoTaxCalculator - IRS Guidance on Virtual Currencies

IRS Virtual Currencies FAQs - Professional Tax Advice

Find a crypto-savvy CPA

Summary

Running your crypto mining, staking, or trading operation as a business can transform taxable income and save you thousands in taxes. The key is to keep detailed records, formalize your activities, and leverage every deduction available. As crypto tax rules evolve, working with an experienced professional and using specialized AI tax research or planning tools can make all the difference.

Ready to maximize your crypto deductions? 👉 Book a demo with Hive Tax AI and discover how agentic tax planning can revolutionize your tax planning approach.