Discover how AI tax tools are transforming the tax and financial industry. Explore how AI tax research and AI tax planning tools powered by agentic AI in tax can enhance accuracy, efficiency, and client satisfaction. Embrace innovation—click here to learn how to future-proof your practice with AI.

How AI Tax Research and AI Tax Planning Tools Are Transforming the Industry

In the fast-evolving landscape of tax and financial advisory, staying ahead of regulatory updates and optimizing client outcomes is more challenging than ever. Fortunately, advanced technology such as AI tax research and AI tax planning tools, particularly those powered by agentic AI in tax, offer unprecedented opportunities to transform traditional practices.

The Power of AI Tax Research

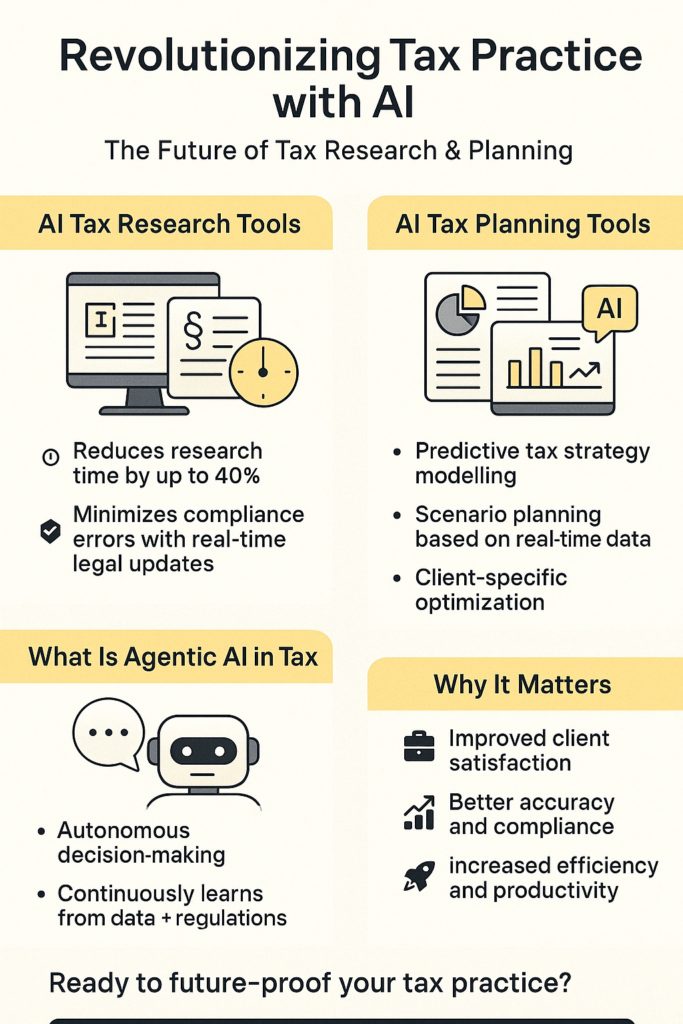

AI tax research tools are changing how tax professionals gather, interpret, and apply complex tax laws and regulations. These AI-driven platforms use natural language processing (NLP) and machine learning algorithms to quickly sift through extensive databases of tax legislation, court cases, IRS rulings, and authoritative guidance from government sources like IRS.gov and Treasury.gov.

According to a report from Deloitte, firms integrating AI tax research tools can reduce research time by up to 40%, significantly enhancing productivity. Moreover, these tools improve the accuracy of research, reducing the risk of costly compliance errors and omissions.

Transformative Impact of AI Tax Planning Tools

Effective tax planning demands precision, forward-thinking, and dynamic responsiveness. AI tax planning tools leverage agentic AI to autonomously analyze extensive client data sets, predict tax outcomes, and recommend optimal tax strategies tailored specifically to each client’s circumstances.

A recent PwC industry report highlights how agentic AI in tax facilitates more accurate forecasting, scenario planning, and strategic decision-making. This translates to significant cost savings and tax efficiency improvements for clients.

Agentic AI in Tax: The Next Frontier

Agentic AI in tax refers to AI systems capable of autonomous decision-making, proactive recommendations, and adaptive learning. These sophisticated platforms continuously refine their predictive models based on new data, client feedback, and evolving tax regulations, offering real-time, actionable insights.

The Journal of Accountancy underscores the necessity of adopting agentic AI to remain competitive, noting its ability to anticipate client needs and offer timely, proactive solutions—key factors in client satisfaction and retention.

Recommended Tools and Resources

To fully harness AI in your tax practice, consider exploring the following:

- Tax Research Platforms: Tools integrating comprehensive tax databases and NLP-driven insights, such as our advanced AI Tax Research Platform.

- AI Tax Planning Software: Platforms designed specifically for predictive analytics and scenario planning, such as our dedicated AI Tax Planning Tool.

- Industry Insights: Regularly consulting authoritative sources like the IRS Tax Professionals Section.

Final Words

Embracing AI tax research and AI tax planning tools isn’t just beneficial—it’s essential for the modern tax professional. These tools not only enhance efficiency and accuracy but also position your practice as innovative and client-centric.

Try Your AI Tax Assistant for Free!

Ready to transform your practice with agentic AI in tax? See firsthand how our cutting-edge AI tax tools can revolutionize your approach to tax research and planning.