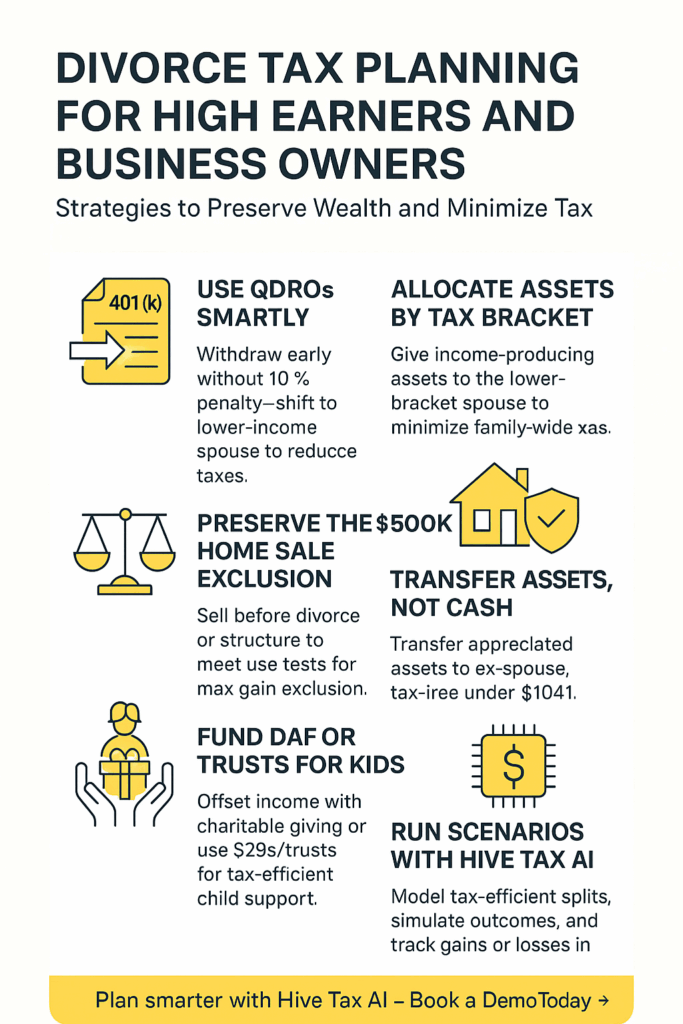

Divorce doesn’t have to be a financial disaster—especially for high-income earners and entrepreneurs who approach it strategically. This guide explores advanced divorce tax planning techniques, including the use of QDROs, asset allocation by tax bracket, property settlement structuring, and business-focused strategies. Learn how to preserve wealth, reduce tax exposure, and structure settlements for long-term tax efficiency. Explore smart tax planning now with AI tax tools designed for complex situations.

Why Divorce is a Critical Tax Planning Opportunity

For high-net-worth individuals and business owners, divorce is not only an emotional event—it’s a major financial transition. But with strategic planning, it can also be an opportunity to mitigate taxes. The key lies in using both spouses’ tax attributes, income levels, and asset types to design a settlement that reduces total tax exposure.

Below are powerful tax-saving strategies high earners and entrepreneurs should consider, with real-world case studies to show how it all comes together.

1. Use QDROs for Penalty-Free Withdrawals from Retirement Accounts

A Qualified Domestic Relations Order (QDRO) allows the transfer of retirement plan funds between spouses incident to divorce without triggering the 10% early withdrawal penalty.

For business owners under 59½ who need liquidity to fund a settlement, this becomes a tactical advantage:

- Example Strategy: Allocate more of the 401(k) to the lower-income spouse, who then withdraws funds penalty-free and provides liquidity for both parties.

- Tax Benefit: Avoids the 10% penalty and potentially results in income taxed at a lower rate, reducing the total tax burden.

2. Allocate Income-Producing Assets to the Lower-Bracket Spouse

After divorce, each party files taxes separately. That means:

- Giving more bonds, rental real estate, or dividend stocks to the lower-income spouse minimizes family-wide tax on income.

- The higher-income spouse can take assets with tax deferral or long-term growth potential.

This asset allocation strategy must be negotiated carefully, often requiring financial modeling and trust between parties.

3. Maximize the $500K or $250K Home Sale Exclusion

The principal residence exclusion allows married couples to exclude up to $500,000 in gain, or $250,000 if filing individually. The couple should:

- Sell while still married to claim the $500K exclusion.

- Or ensure the retaining spouse meets the ownership and use tests for $250K exclusion.

Pro Tip: A transfer between spouses under §1041 is tax-free but doesn’t trigger a home-sale exclusion. Selling to a third party before the divorce finalizes may be a better tax outcome.

4. Use Charitable Contributions to Offset Income in the Divorce Year

If high-income is expected in the year of divorce (e.g., from selling a business), use charitable planning:

- Fund a Donor-Advised Fund (DAF) or private foundation before splitting assets.

- Deduct charitable contributions on the final joint return.

This reduces taxable income and can reflect shared philanthropic goals.

5. Use Trusts and 529 Plans to Support Children Tax-Efficiently

Tax-savvy parents can use:

- 529 college savings plans for tax-free educational growth.

- Irrevocable trusts to structure child support funds with potential tax deferral or lower-bracket taxation.

Watch for Kiddie Tax implications, but with proper planning, this front-loads child expenses in a tax-favorable way.

6. Strategic Income Timing for Business Owners

Business owners anticipating divorce can benefit by:

- Delaying income until after divorce if they expect to be in a lower tax bracket.

- Avoiding excessive manipulation that could trigger legal disputes.

When executed reasonably, this tactic can defer high-bracket taxation.

7. Transfer Appreciated Assets Instead of Cash

Instead of liquidating and paying taxes, entrepreneurs may:

- Transfer investment real estate or business interests to the ex-spouse.

- The recipient can later do a 1031 exchange or hold the asset until death for step-up.

This avoids triggering capital gains taxes at the time of divorce.

8. Harvest Capital Losses Before Finalizing Settlement

Couples can:

- Realize capital losses before divorce and allocate the benefit in settlement.

- Use those losses to offset gains on appreciated assets awarded to the other spouse.

This strategy is especially useful in rebalancing portfolios as part of the marital split.

9. Assign Tax-Deductible Expenses Thoughtfully

Certain expenses—like:

- Tax advice within legal fees

- Medical expenses for dependents

Can be structured to favor the spouse with itemized deductions. Timing and assignment matter—especially when large deductions are involved.

Case Study 1: Tax-Efficient Business Settlement

Scenario: Alan owns a $20M S-Corp. He can’t afford to buy out his spouse Beth immediately.

Solution:

- Alan keeps the business.

- Beth gets a vacation home, portfolio assets, and installment payments over 5 years.

- No capital gains are triggered via §1041 transfers.

- Installment payments are structured as a property settlement, not alimony—avoiding tax complications.

Result: Alan retains control of his company. Beth gets diversified assets she can manage for tax efficiency.

Case Study 2: Replacing Alimony with Upfront Property Division

Scenario: Eric, a high-earning surgeon, and Diana, a stay-at-home mom, divorce in 2025.

Strategy:

- Instead of taxable alimony, Diana receives a rental property and bonds for income.

- Additional lump-sum payments are clearly labeled property settlement, not support.

- Diana avoids dependency on alimony, and Eric avoids paying nondeductible spousal support.

Result: Both parties reduce post-divorce tax risk while maintaining financial independence.

How AI Tax Tools Help You Plan Divorce Settlements Smarter

Divorce tax planning is complex—and ripe for AI-driven insights. At Hive Tax AI, we offer cutting-edge AI tax planning tools tailored for high-net-worth divorce scenarios. Our tools help advisors:

- Run simulations for asset splits

- Model tax outcomes by bracket and asset class

- Track capital gains exposure and loss harvesting opportunities

- Leverage agentic AI for continuous strategy updates

With AI, divorce tax planning moves from reactive to strategic.

Final Thoughts: Two Taxpayers Are Better Than One (Sometimes)

Divorce doesn’t have to be a tax disaster. For high earners and business owners, the split offers a chance to rethink tax positioning. With careful planning, both parties can come out ahead—financially and tax-wise.

Call to Action

Want to see how AI-powered tax planning can optimize your client’s divorce settlement?

👉 Book a demo with Hive Tax AI for advanced tools built for high-net-worth advisors.