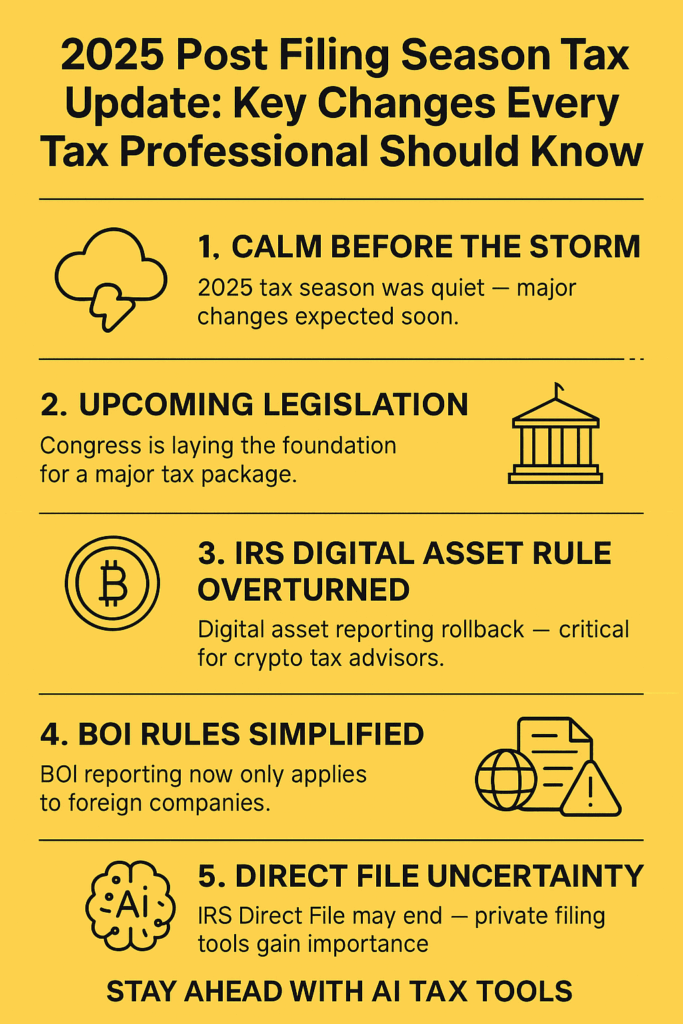

The 2025 tax filing season passed quietly, but major regulatory shifts are on the horizon. In this Post Filing Season Tax Update, we cover important changes around IRS digital asset reporting, BOI enforcement, obsolete IRS guidance, and the uncertain future of Direct File. With Congress preparing major tax legislation and government efficiency initiatives underway, this is a critical time for financial and tax professionals to stay informed. Learn how AI tax research, AI tax tools, and agentic AI in tax can help you stay ahead of these developments.

2025 Tax Filing Season: A Calm Before the Storm

The 2025 tax filing season felt unusually subdued. Congress did not pass major tax legislation during the season, but important groundwork has been laid for significant changes later this year. Meanwhile, the IRS and Treasury Department focused largely on regulatory reviews rather than new initiatives.

No major announcements were made regarding filing season performance, and with the IRS facing workforce reductions and leadership turnover, many expect administrative disruptions in the months ahead.

“In many ways, the 2025 filing season feels like the calm before the storm.”

No Tax Legislation Yet, But Foundations Are Laid

While no major tax legislation was enacted during filing season, Congress is moving towards a massive reconciliation package that could permanently extend the Tax Cuts and Jobs Act (TCJA) provisions. A series of IRS administrative reform bills also advanced in the House, including:

- H.R. 1152 – Electronic Filing and Payment Fairness Act

- H.R. 998 – Internal Revenue Service Math and Taxpayer Help Act

- H.R. 517 – Filing Relief for Natural Disasters Act

- H.R. 1491 – Disaster Related Extension of Deadlines Act

- H.R. 997 – National Taxpayer Advocate Enhancement Act

- H.R. 1155 – Recovery of Stolen Checks Act

These efforts indicate Congress’s focus on taxpayer service improvements and disaster response flexibility.

IRS Digital Asset Reporting Rule Overturned

One of the most notable regulatory actions was the rollback of the “Gross Proceeds Reporting by Brokers that Regularly Provide Services Effectuating Digital Asset Sales” rule. Initially set to tighten digital asset transaction reporting starting in 2027, this rule was overturned due to concerns over excessive taxpayer burden and minimal enforcement value.

For tax professionals advising clients in the digital asset space, staying current with reporting obligations is essential. Leveraging AI tax research tools can streamline the complex and evolving landscape of digital asset taxation.

BOI Reporting Requirements Narrowed

In a significant reversal, the Treasury Department announced that the Beneficial Ownership Information (BOI) regulations will no longer be enforced for U.S. citizens or domestic companies. Future BOI rule changes will focus solely on foreign companies, simplifying compliance requirements for many U.S.-based businesses.

Obsoletion of Prior IRS Guidance

Driven by President Trump’s Executive Order 14219 and the Department of Government Efficiency initiative, the IRS declared nine outdated pieces of guidance obsolete in April 2025. Expect hundreds more to be revoked soon.

This effort underscores the need for practitioners to rely on updated, AI-driven tax research platforms that prioritize current law and remove outdated references. AI tax tools that dynamically update based on IRS changes can prevent costly errors.

Direct File Program Likely Ending

The IRS’ Direct File program, which allowed taxpayers in 25 states to file directly with the IRS, appears unlikely to continue beyond 2025. Despite some successes, political opposition, cost concerns, and legal authority questions have imperiled the program’s future.

If discontinued, taxpayers will rely even more on traditional filing methods, making accurate, accessible tax planning tools more important than ever.

Final Thoughts

The 2025 post-filing season landscape signals major changes ahead. Staying informed, leveraging AI tax tools, and adapting quickly will be crucial for tax professionals and financial advisors.

Get ahead of the curve — explore how our AI tax research can transform the way you serve clients in an evolving tax environment.

Ready to future-proof your tax practice? Contact us to learn how we can help.

References

- CCH® AnswerConnect: Learn more

- CCH® Publications: Shop tax law resources