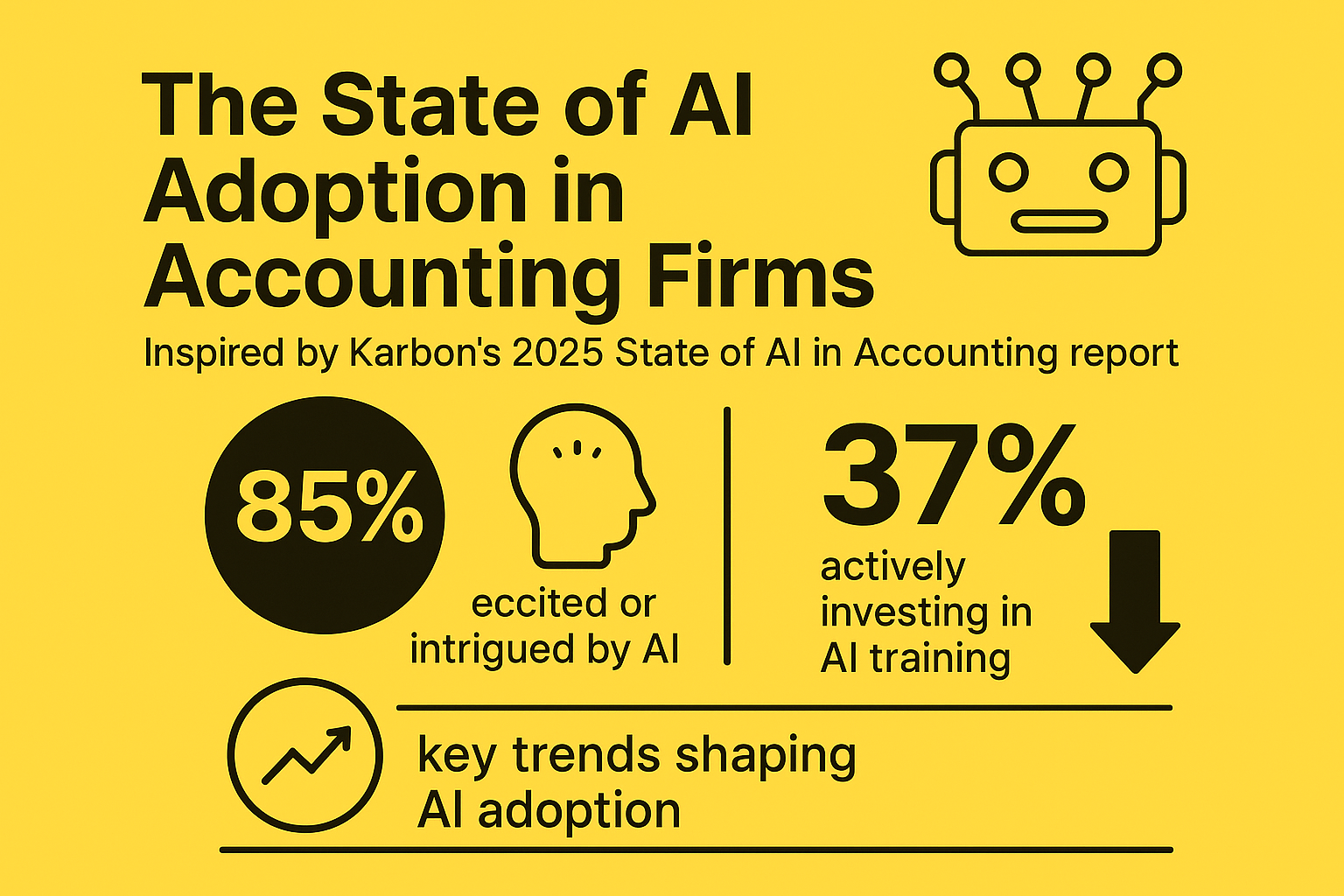

AI has moved from hype to reality in the accounting world. According to Karbon’s 2025 State of AI in Accounting report, over 85% of accounting professionals are excited or intrigued by AI, yet only 37% of firms are actively investing in AI training. In this post, we explore key trends shaping AI adoption in accounting, highlight why some firms are leaping ahead, and offer actionable steps for firms still catching up.

In 2025, AI is no longer a buzzword—it’s becoming the backbone of modern accounting workflows. Karbon’s latest report, The State of AI in Accounting, reveals that while AI adoption is growing across all firm sizes, the degree of impact, perception, and preparedness varies widely.

1. AI Enthusiasm vs. Execution

- 85% of accounting professionals feel excited or intrigued about AI.

- But just 37% of firms provide formal AI training—a gap that may cost firms up to 7 weeks of productivity per year.

- On average, AI saves accounting professionals 56 minutes per day—or nearly 18 hours per month.

- Advanced AI users save 79 minutes per day, compared to 46 minutes for beginners.

2. Use Cases Expanding Beyond Email

- Communication remains the top use case (63%), but AI-driven automation (41%) and meeting transcription (40%) are on the rise.

- Emerging use cases like financial forecasting (13%) and research (39%) show the growing depth of AI’s potential.

3. Firm Size Shapes Sentiment

- Solo and mid-sized firms (21-50 staff) show the most enthusiasm, with 66% expressing excitement.

- Larger firms (51-200 staff) experience more skepticism due to scaling challenges and implementation hurdles.

4. Leadership Matters

- Firm partners and directors are the biggest AI advocates, while individual contributors and admin staff remain more skeptical.

- Leaders who invest in AI training report lower fear and more innovation from their teams.

5. Data Security and Ethics Remain Key Concerns

- 70% of professionals are concerned about AI’s impact on data security, especially operations and tech roles.

- Firms are encouraged to adopt clear AI policies and cybersecurity standards to address these risks.

6. The Advisory Shift

- 72% agree that AI will shift accountants’ roles from compliance to advisory.

- AI frees up nearly an hour a day, redirecting time from low-value tasks to strategic client engagement.

What Can Firms Do Now?

- Start small but start now. Pilot AI tools in communication, workflow automation, or research.

- Prioritize training. Even basic training can boost productivity by 71%.

- Create an AI policy. It’s not about restriction, but creating a safe space to innovate.

- Talk about it. Internal discussions can dispel fear and inspire experimentation.

Conclusion: The accounting profession stands at a crossroads. AI will not replace accountants—but accountants who use AI effectively will replace those who don’t. Forward-looking leaders must move beyond curiosity and commit to thoughtful, secure, and scalable AI integration.

Let’s not wait to be disrupted. Let’s lead the transformation.

Read the full report

Explore how our HIVE AI tax research tool can support your practice: 👉 Sign Up for Free Trial Today