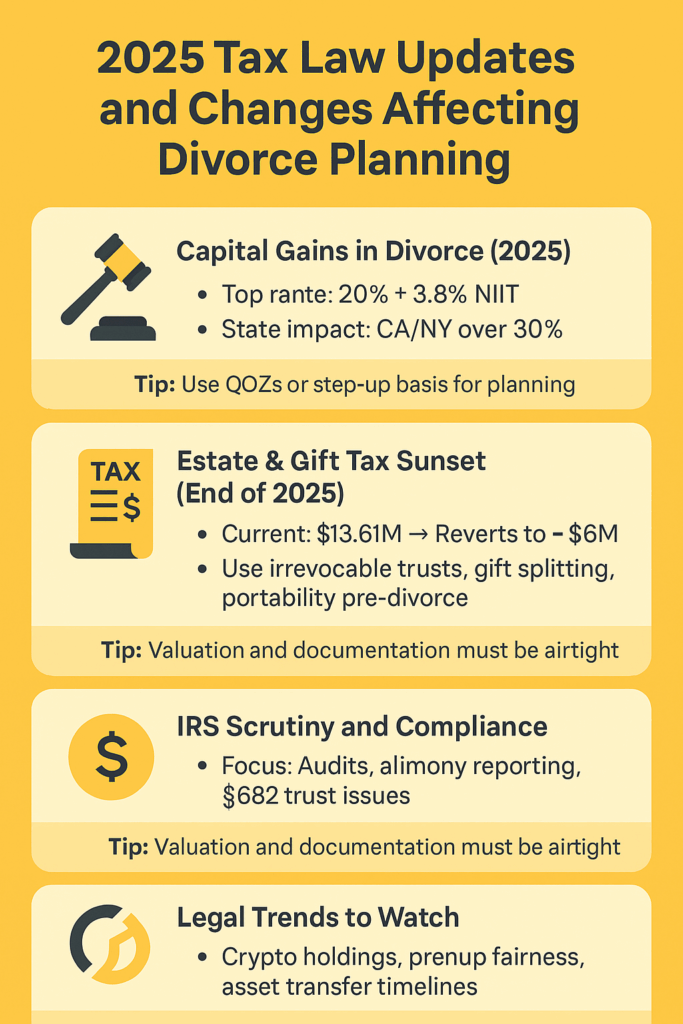

Divorcing in 2025? Tax changes and upcoming sunsets can have a profound impact on asset division, estate planning, and post-divorce finances—especially for high-net-worth individuals. From capital gains to estate exemption shifts and IRS scrutiny, smart divorce planning now means fewer tax headaches later. Here’s what you need to know.

Capital Gains and Investment Tax Considerations

While there’s been no major change to capital gains tax rates in 2025, the environment remains complex and subject to future shifts:

- Federal capital gains rates: The top long-term capital gains rate remains at 20%, plus the 3.8% Net Investment Income Tax (NIIT) for high-income earners.

- State-level impact: In high-tax states like California and New York, total capital gains taxes can exceed 30%. Relocation by one spouse could affect future tax liabilities on asset sales.

- Planning strategies:

- Qualified Opportunity Zones (QOZs) can help defer or reduce gains from appreciated assets.

- Step-up in basis at death remains in place, offering an incentive in collaborative divorces where one party may inherit an asset.

- Qualified Opportunity Zones (QOZs) can help defer or reduce gains from appreciated assets.

Key Insight: Even without new laws, managing capital gains in divorce requires proactive planning—especially for appreciated assets like stock portfolios, real estate, or business interests.

Estate and Gift Tax Sunset: A Looming 2026 Deadline

One of the most consequential tax changes looming is the scheduled sunset of the current estate and gift tax exemption at the end of 2025:

- Current exemption: Approximately $13.61 million per person in 2025 (adjusted for inflation from $12.92M in 2023).

- Post-2025: Reverts to ~$6 million per person (2011 levels plus inflation).

Divorce Planning Implications

- Lock in the exemption: Divorcing couples with significant wealth can consider funding irrevocable trusts or making large gifts in 2025 as part of a broader settlement strategy.

- Gift splitting: Spouses can split gifts while still married. Post-divorce, this benefit disappears.

- Portability considerations: After divorce, unused exemption can no longer transfer between ex-spouses.

- Life insurance in trusts: With a lower exemption on the horizon, updating insurance trusts post-divorce is crucial for future estate tax coverage.

Pro Tip: Wealthy divorcing couples may benefit from coordinated estate planning strategies to preserve exemptions before the law changes.

IRS Enforcement and Divorce Tax Compliance

The IRS is increasing audits and scrutiny of wealthy taxpayers in 2024–2025, which has real consequences for divorcing couples:

- Valuation audits: Transfers of business interests, real estate, or art during divorce must be accurately valued and well-documented to avoid IRS challenges.

- Alimony reporting: Post-TCJA, new alimony agreements aren’t deductible or taxable, but older agreements remain under IRS review for compliance.

- Trust structuring and §682 repeal: Payments from trusts post-divorce must be carefully structured to avoid triggering unintended gift or income tax issues.

- Documentation is critical: Settlements should clearly outline asset transfers, valuations, and tax reporting positions to survive potential audits.

Tip: IRS scrutiny means divorce settlements must be bulletproof. Clean documentation and professional tax guidance are essential.

Legal Precedents Shaping Divorce Taxation

Though 2025 didn’t bring a blockbuster Supreme Court ruling, a series of decisions continue to shape how divorce and tax intersect:

- Tax-aware asset division: Courts increasingly factor in the latent tax liabilities of assets when dividing property.

- Cryptocurrency: Hidden or undisclosed crypto holdings can lead to financial penalties or uneven distributions.

- Pre/post-nuptial agreements: Must be properly executed and fair; otherwise, they risk being invalidated—reopening tax exposure.

- Section 1041 rulings: Reinforce that property transfers must occur per the divorce decree and within IRS-defined timelines to be tax-free.

Bottom Line: Legal trends are making tax-smart divorce planning both more complex and more necessary.

Final Thoughts and Takeaway

The 2025 tax landscape offers both risks and opportunities for divorcing couples—particularly high-net-worth individuals. With a shrinking estate exemption on the horizon, aggressive IRS enforcement, and nuanced legal precedent, tax-savvy divorce planning is no longer optional.

✅ Next Step: Collaborate with a tax advisor early in the divorce process. Whether you’re negotiating complex asset transfers, designing trusts, or updating estate plans, tax strategy must be part of the conversation. 👉 Book a demo with Hive Tax AI for advanced tools built for high-net-worth advisors.